Behavioral economics reveals insights into the biases and behaviors of humans

Arya Maheshwari & Wikimedia Commons

October 26, 2018

At your local 7-Eleven, you walk up to the cash register and take out your wallet. Placing your cherry Slurpee on the counter, out of the corners of your eyes you see lit-up numbers flashing that the current jackpot for the Powerball is $620 million. As the Los Angeles Times said, “a person is more likely to have an 11th toe, die from flesh-eating bacteria or be killed by an asteroid or shark attack” than win those 1 in 292 million odds in the Powerball.

Yet, despite the towering improbability of winning, Americans spent $73.5 billion on lottery tickets in 2016, according to ABC News. Why do we pull out the $2 to buy a Powerball ticket even when the odds are so terribly stacked against us?

“We overstate of when odds are in our favor, which is why you see so many people buying lottery tickets,” Michael Sheldon, an Uber data scientist who spoke about behavioral economics for the upper school economics club last year, said in an interview. “It never really makes any rational sense to buy a lottery ticket, but people do it all the time because they overweight the possibility that they will win—they’re overconfident.”

This outweighing of positive odds is one of many themes of behavioral economics. While normal, also known as neoclassical, economics assumes that people are unemotional, rational beings all of the time, behavioral economics studies the more realistic behavior of humans and debunks the rationality model that neoclassical economists presume.

“Behavioral economics takes all of the assumptions of regular economics that aren’t really realistic and makes them a little bit more realistic. Economics assumes that people are always rational and always behaving in their best interests, like hyper rational calculators or robots,” upper school mathematics and economics teacher Dean Lizardo said. “What I love about behavioral economics is just since it’s so much more realistic in the way that it explains the real world. I want students to be able to take these concepts and actually be able to apply them.”

Another distinction from normal economics is that behavioral economics does not have any fixed foundation of ideas.

“Behavioral economics doesn’t really have a unified centralized model or set of principles. It’s really just a set of criticisms against the rational model [of neoclassical economics],” Sheldon said. “[Though] there are definitely major common themes across what behavioral economists study or issues with the rational model that have something in common.”

This year, the Business and Entrepreneurship department at the upper school introduced a new semester-long course, Behavioral Economics, taught by Lizardo. The class delves into sociology and psychology to help explain human behavior.

“We talk about gambling almost every other class. It’s a very good example of a lot of things in behavioral economics because it’s very representative of taking a loss or a gain and how you react to it,” Behavioral Economics student Katrina Ipser (12) said. “We cover a lot of different topics that all have to deal with people’s perceptions of things that happen to them.”

Behavioral economics research is especially useful to companies as a theoretical model for consumer decision-making. One major technique that businesses can use to increase engagement with consumers is gamification. Just as the word implies, gamification is a strategy in which companies incentivize their consumers with goals styled similarly to a game.

“A lot of the really big companies, especially here in Silicon Valley, like Google, probably use some form of gamification or incentivization to take advantage of behavioral economics,” Lizardo said. “I guarantee you that the techniques that they use leverage behavioral economics—they just might not be completely aware of it.”

The ridesharing company Uber, for example, rewards drivers with badges for reaching certain achievements. Uber also sends notifications to drivers urging them to meet a certain sum for the day to covertly compel them to drive for longer, a technique called nudge. Also known as libertarian paternalism, nudge is a concept that implies there are ways to influence people’s actions without directly using words.

“Nudges are used in public policy. To give an example, if an employer has a default option that says, ‘I’m going to put five percent of your paycheck away each week for your savings,’ people just have a tendency to save more, versus if the default was zero,” Lizardo said. “That’s a nudge, because people default to the status quo and have a tendency to not want to change the status quo.”

Behavioral economics outlines many biases in human behavior that reveal gaps in rationality, such as the status quo bias.

“There’s a [concept] called the status quo bias, where we’re really prone to stay with simple options, or we don’t change our choices enough,” Sheldon said. “Once we pick something, we usually stay with it, even though the cost and benefit of that choice may have changed.”

Other biases include the consumer’s perception of prices, such as the round number bias, the idea that people react differently to round numbers than to others.

“One of the most common places we see [round number bias] is when you go shopping at a store and you see a ton of products that end in 99 cents. The difference between a product which costs $10 and [another at] $9.99 is super trivial, yet people act really strongly when they see $10 as a round number,” Sheldon said. “When they see $9.99, they actually are more likely to interpret that as $9 than $10, even though it’s obviously much, much closer to $10.”

Important methods that companies, such as the rental platform Airbnb, use to form trust between customers and hosts include signaling and reciprocity.

“[Airbnb has] done a lot of really good research to make sure that both host and guest have really good first interactions when they use the platform. Specifically, they found that people are more willing to trust people who trusted them,” Sheldon said. “Signaling that you trust someone is a really strong way to get that person to act in a more trustworthy manner toward you. With that knowledge, Airbnb has developed [their] app in such a way that hosts typically endow a lot of trust with their guest.”

After hearing of these different techniques and “tricks” that businesses utilize, should consumers fear that companies are taking advantage of them in a world as seemingly materialistic as ours?

“The key thing to understand about behavioral economics is that they are not really creating any new techniques or ideas on how to trick people. The whole idea is to reveal pre-existing biases and characteristics in hopes of educating people about them,” Sheldon said. “Knowing these things gives you powerful tools, and those tools can always be applied with bad or manipulative intentions, and maybe not necessarily directly ‘manipulative,’ but in a way that as a consumer, you should be aware of and realize [when] someone is trying to sell you something that you might not need.”

As irrational and complex as humans are, behavioral economics can help to explain the reasons behind consumers’ decisions. After learning several basic ideas in behavioral economics, perhaps you as a customer will be more likely to recognize the biases you make in everyday decision making.

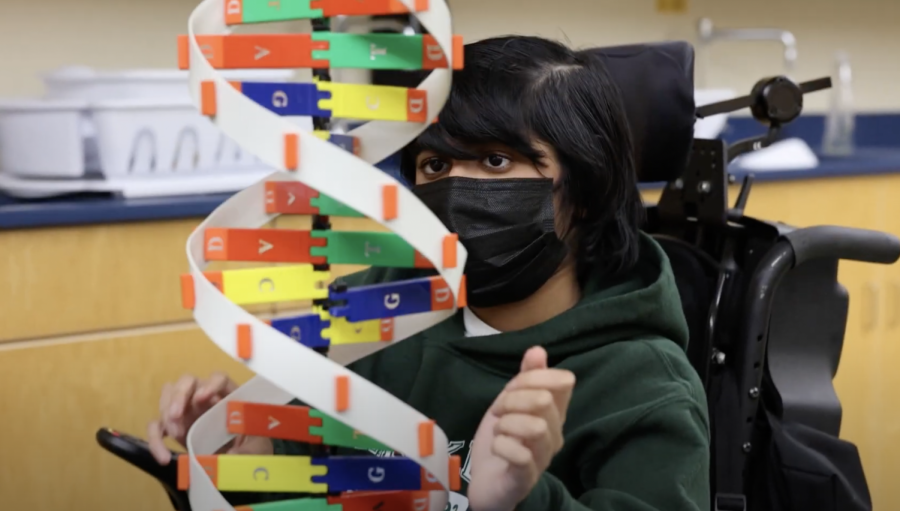

![“[Building nerf blasters] became this outlet of creativity for me that hasn't been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but I've had to learn from [the skills needed from] soldering to proper painting. There's so many different options for everything, if you think about it, it exists. The best part is [that] if it doesn't exist, you can build it yourself," Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

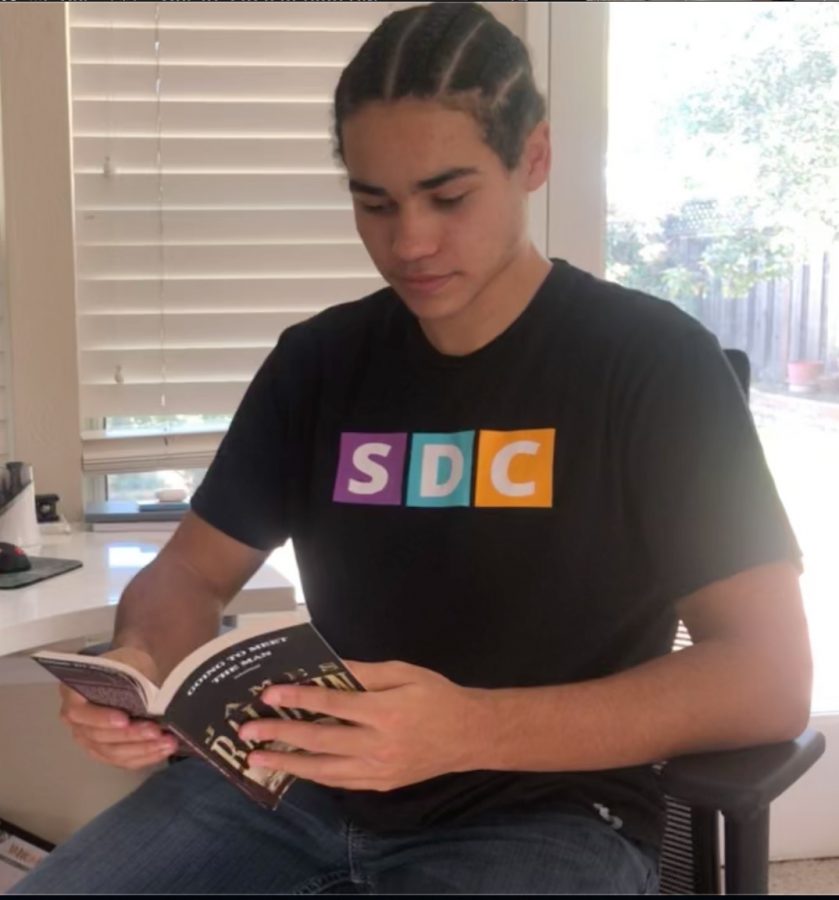

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and it's played such a major role in who I've become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something I'm [really] proud of,” Anvitha Tummala ('21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you aren't going to get those championships if you aren't fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

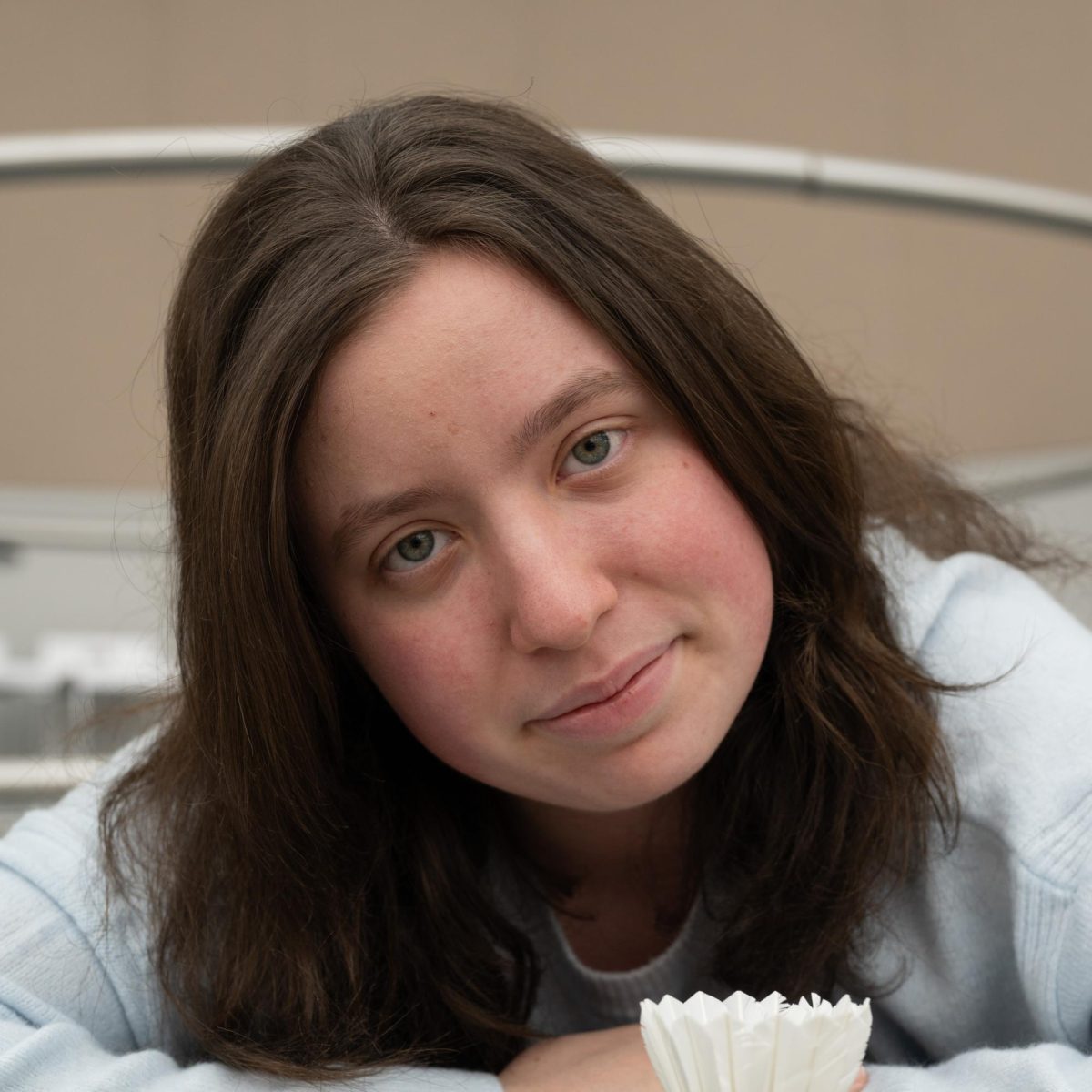

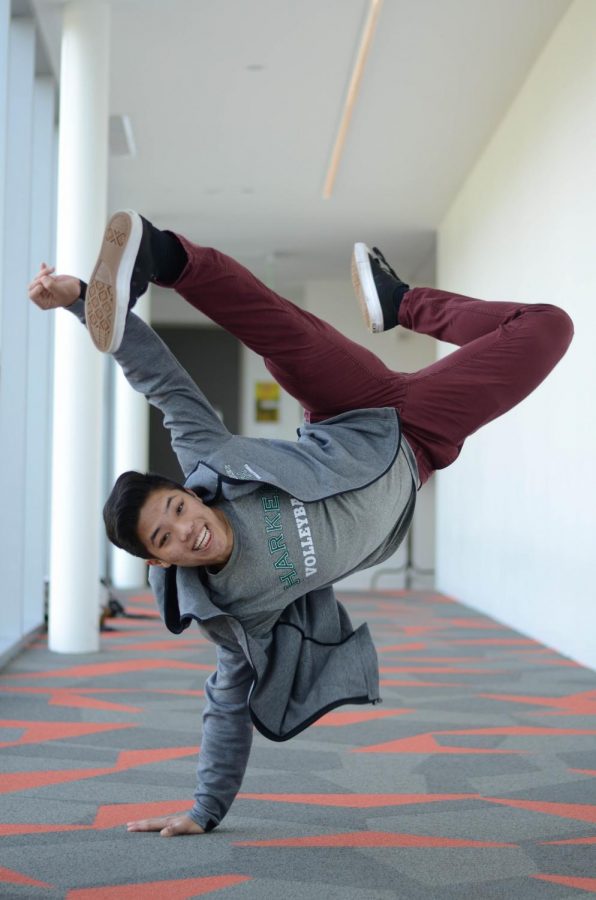

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

![“I'm not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that there's a lot of people that are really confident in what they do, and I really admire them. Everyone's so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)