S&P 500 skyrocketed 9.5% on April 9, the largest daily gain since 2008, as a result of President Donald Trump suspending tariffs for 90 days on all trading partners except China.

Trump announced 145% tariffs on all Chinese imports, and China responded with 125% retaliatory tariffs on the U.S on April 11. The escalating tariff war between the U.S. and China has triggered massive daily swings in the stock market. S&P 500 plummeted 9.1% over the course of last week, the worst week since the 2020 pandemic crash.

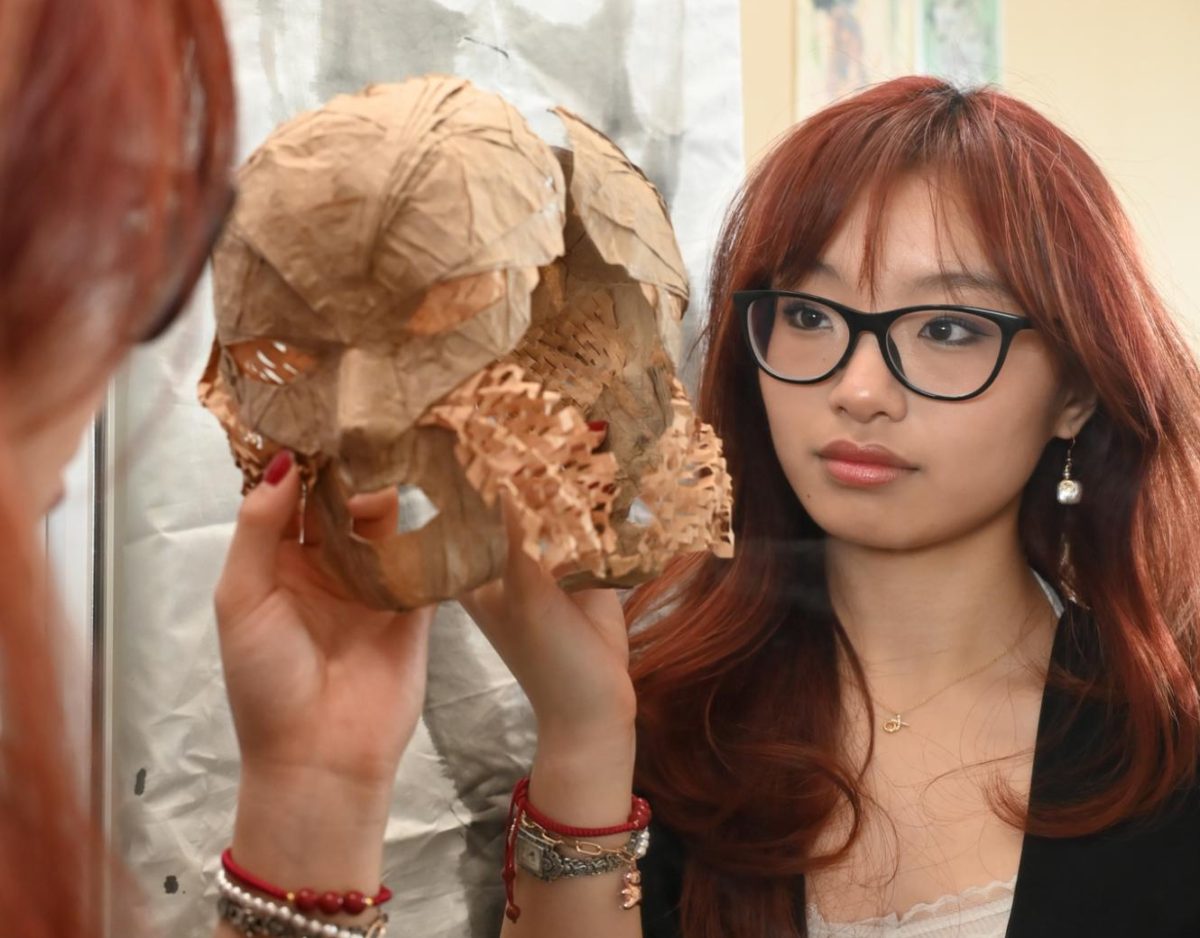

AP Economics student and Oeconomia officer Leana Zhou (11) pointed out that anxiety over the tariffs initially triggered the market crash. She explained that the high tariffs led investors to think that they might lose money, prompting rapid stock sell-offs that deepen the market downturn.

“This uncertainty with the stock market really indicates where we’re going to go with our economy in the future,” Leana said. “When all these people are seeing the stock market is volatile, they’re less willing to invest, which is kind of ironic in that it does the exact opposite of what the tariffs are trying to do.”

Trump declared reciprocal tariffs on all trading partners on April 2, which he dubbed “Liberation Day,” including taxes upwards of 10% on all imported goods. He later suspended those tariffs for 90 days on all trading partners except China, for whom he raised tariffs to 125%, on April 9. This sudden pull-back on many tariffs caused the stock market to recover, with S&P 500 shooting up 7% almost immediately.

Economics teacher Dean Lizardo described the high-stakes tariff war between China and the U.S. as an example of brinkmanship, where rival nations continually escalate tensions to pressure the other side into backing down. Lizardo argued that Trump is pushing China in a “game of chicken” in hopes that they will yield. However, President Xi Jinping has signaled that China has no intention of backing down, declaring in his first public comment since the tariff war escalated, that the country is “not afraid of any unreasonable oppression,” according to a China Central Television broadcast.

“You’re trying to escalate just so you can get enough concessions from your opponent,” Lizardo said. “Trump’s brand of economic policy, especially when it comes to trade, is, ‘Look, we’re going to impose these huge tariffs on you, and you’re gonna have to give something up so that we can eventually get what we want.’ The big question is who’s going to be the one to actually concede.”

Managing Director at HSBC Innovation Banking Devika Patil believes that tariffs may weaken large companies that rely heavily on oversea supply, like Apple, which shipped 600 tons of iPhones from India to the U.S. to avoid expensive tariffs on April 10. However, Trump exempted smartphones and computers from reciprocal tariffs on April 12, and on Monday he claimed that he planned to add a tariff on chips later. From a venture investor’s perspective, she hopes that the tariffs will open up new domestic investment opportunities in startups, especially those working in AI and semiconductor industries.

“Over time, the economy needs more innovation and investment, not just barriers,” Patil said. “Especially in export-heavy sectors, they could feel more pressure from the tariffs and the taxes. Public markets will wobble, but private capital on the venture side sees volatility as a buying opportunity.”

Patil noted that rapid information exchange through communication technologies has heightened investor concern since the spread of global news can intensify the market effect of political and economic shifts. Trump’s other recent actions, including mass layoffs and budget cuts, have added to consumer uncertainty, leading to a decrease in overall spending and investment.

“Even though we’ve seen large scale volatility before and past stock market downturns, this time it’s layered on top of inflation, AI disruption and the shifting global alliances,” Patil said. “Investors, consumers and foreign partners all crave stability, which they’re not seeing right now, especially from a country like the United States that has a reputation of being one of the world leaders.”

Impacts of the tariff war have spread through the international economy. Index funds reacted by tumbling across most of Europe and the Asia-Pacific. London’s FTSE 100 dropped 2.9%, Tokyo’s Nikkei 225 sank 3.9% and the CAC 40 fell 3.3% in Paris on April 9. Chinese stocks were an outlier that day, with indexes rising 0.7% in Hong Kong and 1.3% in Shanghai. Bond prices also shifted rapidly as faith in the U.S. bond swayed, which, up until the enforcement of new tariffs last week, was widely considered an economic safe haven.

Lizardo described the drastic global impact that the tariff war causes.

“If these tariffs were to maintain themselves long term, you would essentially be running a very high risk of putting not just America but many countries into a recession,” Lizardo said. “You’re basically disincentivizing people to spend money, and you’re also making it far more expensive for businesses to operate.”

![“[Building nerf blasters] became this outlet of creativity for me that hasn't been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but I've had to learn from [the skills needed from] soldering to proper painting. There's so many different options for everything, if you think about it, it exists. The best part is [that] if it doesn't exist, you can build it yourself," Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and it's played such a major role in who I've become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something I'm [really] proud of,” Anvitha Tummala ('21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you aren't going to get those championships if you aren't fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

![“I'm not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that there's a lot of people that are really confident in what they do, and I really admire them. Everyone's so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)

![LALC Vice President of External Affairs Raeanne Li (11) explains the International Phonetic Alphabet to attendees. "We decided to have more fun topics this year instead of just talking about the same things every year so our older members can also [enjoy],” Raeanne said.](https://harkeraquila.com/wp-content/uploads/2025/10/DSC_4627-1200x795.jpg)