Cryptocurrency must solve its wasteful energy consumption

Changing to a new system can reduce energy usage by 99.5%

Anika Mantripragada

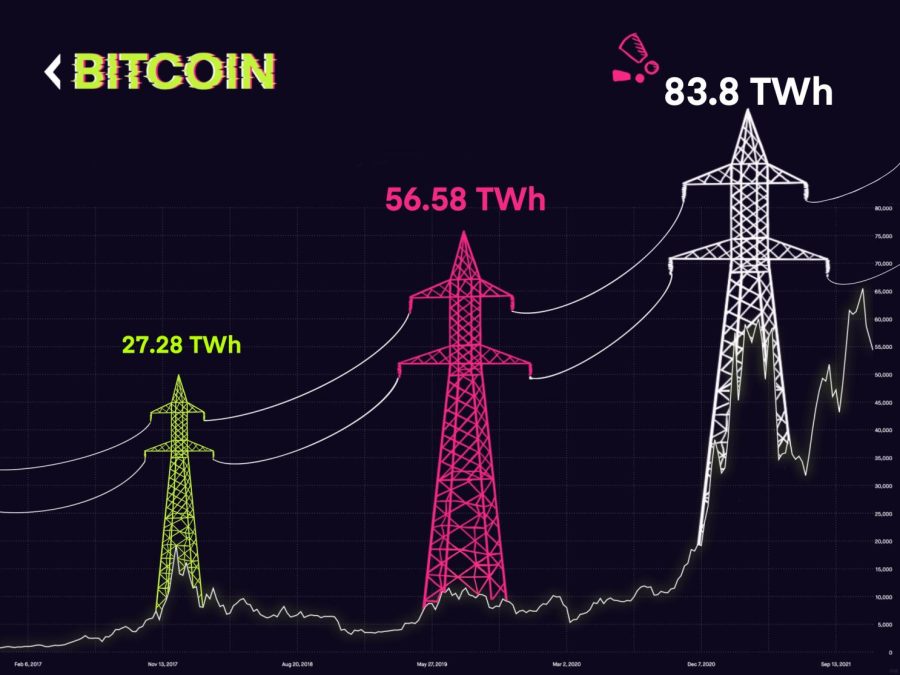

Since hundreds of thousands of people are constantly using electricity to continuously process and verify these transactions, Bitcoin miners, people who participate in verifying blocks, alone consume about 195 terawatt-hours of electricity every year, which is comparable to 34.2% of Canada’ annual energy consumption. Bitcoin itself has an annual footprint of 92.6 megatons of carbon emission, similar to the footprint of the whole country of Nigeria.

December 6, 2021

The mystery of the ever-perplexing “blockchain” often obscures access to cryptocurrency, and non-fungible tokens (NFTs) are becoming the new, trendy future of digital art collecting for the wealthy in the age of an online world. Even if only a portion of people make use of cryptocurrency and NFTs, cryptocurrency has a negative impact on all sectors via its detrimental effects on the environment and the massive amount of energy consumption it encourages.

Cryptocurrency is a digital form of currency, but instead of centralized banks managing the flow of wealth, its transactions are public via the blockchain, which is a public ledger that keeps an identical log of all transactions on each user’s laptop. The blockchain keeps a record of transactions through “blocks,” which follow a chronological order and contain data about the exchange, and users keep the system credible and trustworthy by verifying and then adding blocks to the ledger, for which they receive cryptocurrency.

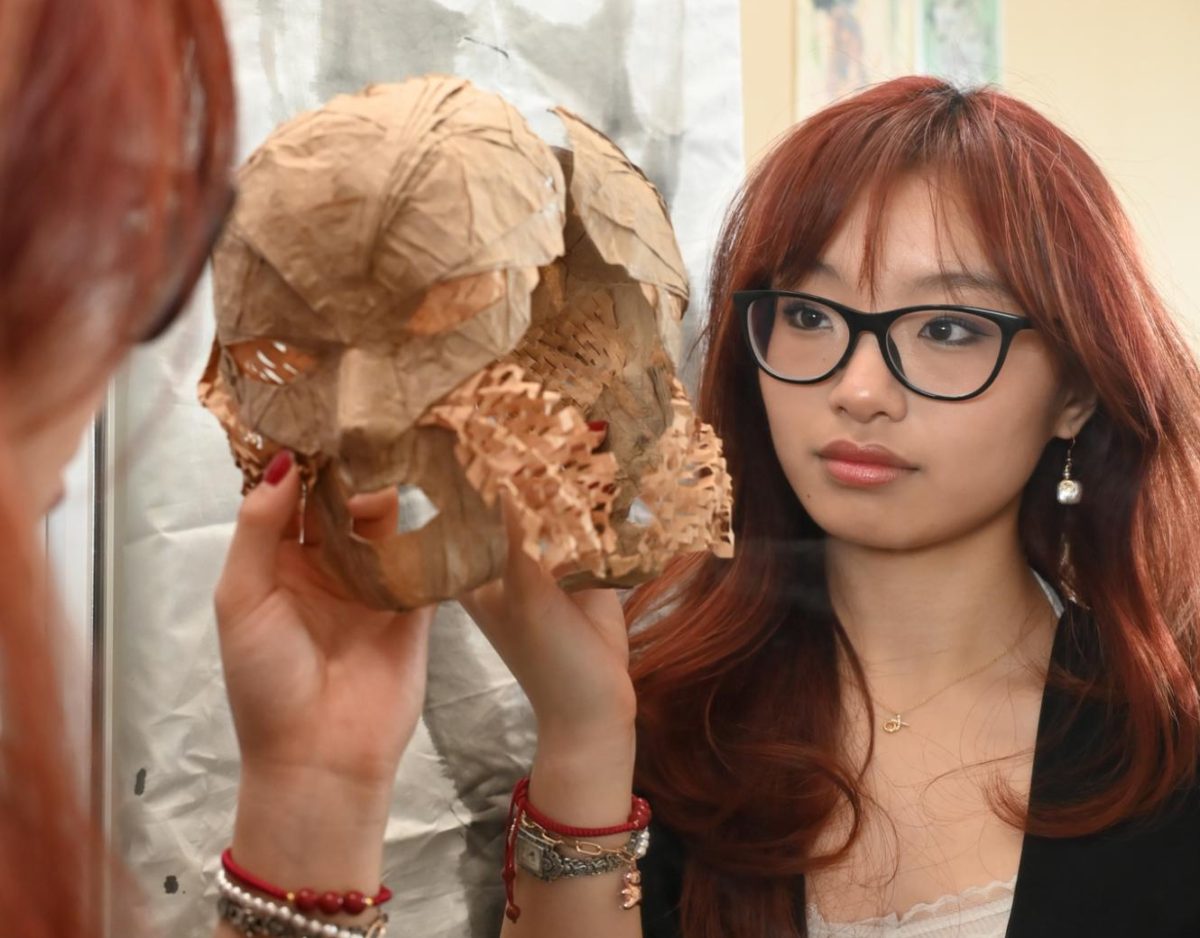

Users can not only trade cryptocurrency but also NFTs on the blockchain, and that’s how NFTs pass on from owner to owner. An NFT is a unique string of numbers that corresponds to a digital file. Just as painters create an original work with their signature and brush strokes, digital creators can produce an original, irreplaceable file of their work or of a piece of media, an NFT, that they can sell online through blockchain.

Each laptop or device connected to the blockchain holds an individual copy of this massive log. This means that if someone tries to hack the system and increase their share of cryptocurrency artificially by faking a transaction, many individual laptops will show that the transaction is false because each device has a separate, but united copy of the blockchain.

But, how do people verify these transactions and find that they’re false in the first place? That’s where cryptocurrency’s proof-of-work system comes into play. In order to verify a transaction, high processing computers work to solve problems in order to integrate new blocks into the record, and the first person to solve the puzzle and verify the transaction receives that specific cryptocurrency as a reward for keeping the blockchain secure.

The problem with this system? Since hundreds of thousands of people are constantly using electricity to continuously process and verify these transactions, Bitcoin miners, people who participate in verifying blocks, alone consume about 195 terawatt-hours of electricity every year, which is comparable to 34.2% of Canada’ annual energy consumption. Bitcoin itself has an annual footprint of 92.6 megatons of carbon emission, similar to the footprint of the whole country of Nigeria. In comparison to other countries, Bitcoin is the 24th largest consumer of electricity.

Fortunately, there is a solution to the problem of energy consumption. As of now, most cryptocurrencies use the proof-of-work system, but proof-of-stake is much less energy-expensive, although it has its downsides as well.

In a proof-of-stake system, people use cryptocurrency as collateral, depositing money into the network for liability’s sake, in order to have the opportunity to validate transactions and therefore receive more cryptocurrency, thus eliminating the competitive aspect of proof of work. Those who invest more cryptocurrency into the system have a higher chance of becoming a validator. One user’s device can then verify a transaction, and if the transaction goes through successfully and then proves as fraudulent, the network takes away the user’s wagered money, their stake. As long as the money at stake is greater than the money a validator can receive, validators have a financial motivation to do their work correctly.

Additionally, the proof-of-stake system means that miners do not need advanced equipment to gain cryptocurrency, which means that more people can get involved with mining. However, proof of stake is still flawed, as it prioritizes the wealthy and allows them to continually accrue more cryptocurrency because they are able to make larger stakes and therefore validate more transactions. In discussing these systems, we must consider the importance of energy usage versus the importance of equity and equality of cryptocurrency income.

I believe that the proof of stake’s significant decrease in energy consumption outweighs its inequitable and unbalanced system and that cryptocurrency companies should shift to proof of stake until a more equitable system comes around. NFTs and cryptocurrencies are exciting new technology, but often artists and investors have neglected to research the overwhelming energy costs and carbon footprint of just a single transaction, which can emit 88kg of CO2 into the atmosphere.

Ethereum is a popular cryptocurrency and a popular avenue for trading NFTs and has used a proof-of-work system for many years and is now working on a proof-of-stake system which they estimate to release in 2022. Even though Ethereum has not fully switched to proof of stake yet, they predict a massive 99.5% decrease in energy usage once they do.

Ultimately, the choice to change from proof of work to proof of stake is mostly up to the major stakeholders of cryptocurrency, who can decide whether they want to continue turning a blind eye and making profits at the cost of the planet’s wellbeing, or they can choose to lead the cryptocurrency industry to a more sustainable, secure future by putting in the work and changing their algorithms.

![“[Building nerf blasters] became this outlet of creativity for me that hasn't been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but I've had to learn from [the skills needed from] soldering to proper painting. There's so many different options for everything, if you think about it, it exists. The best part is [that] if it doesn't exist, you can build it yourself," Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and it's played such a major role in who I've become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something I'm [really] proud of,” Anvitha Tummala ('21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you aren't going to get those championships if you aren't fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

![“I'm not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that there's a lot of people that are really confident in what they do, and I really admire them. Everyone's so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)