Shorts and squeezes: The world of stocks flipped upside down

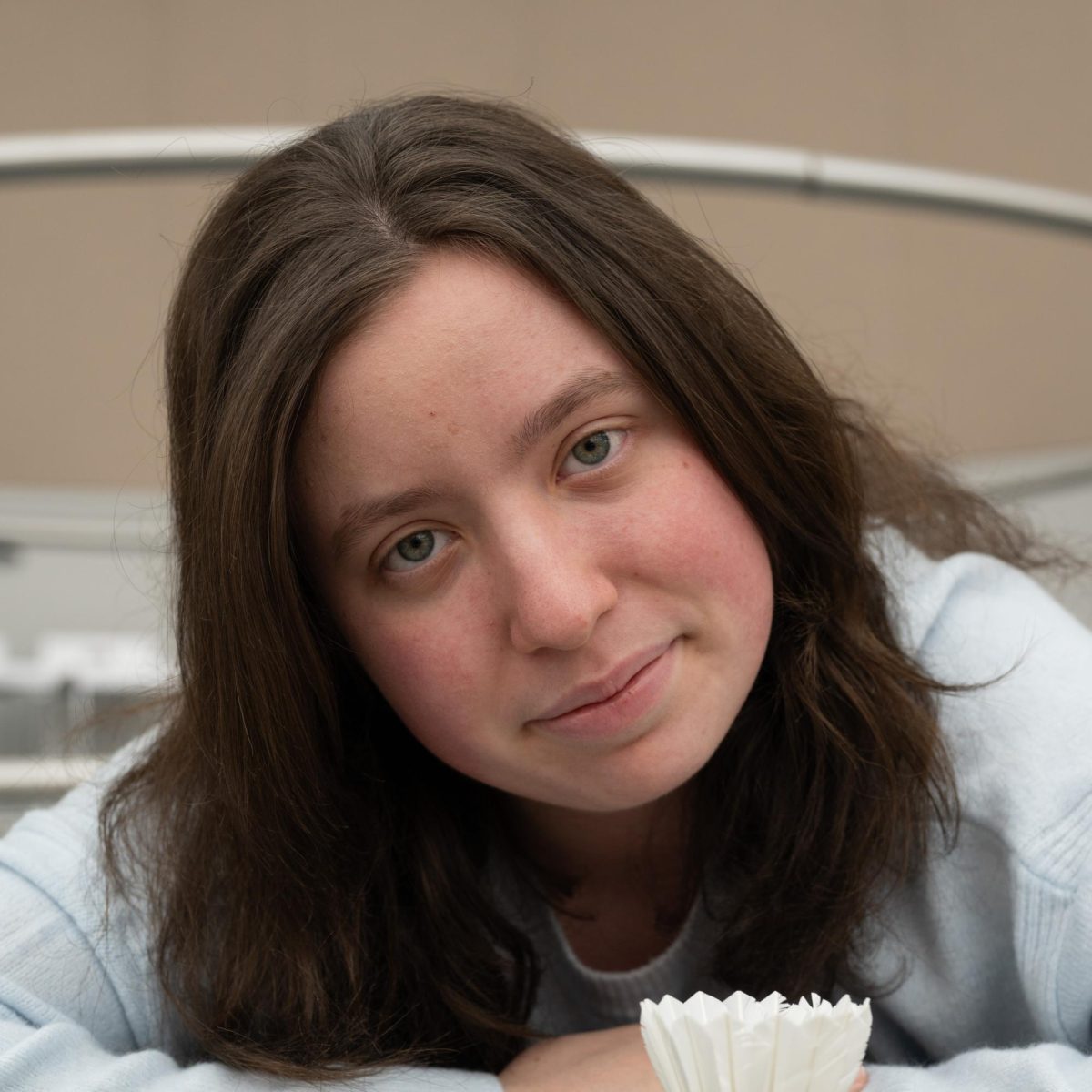

At the pinnacle of Redditors’ buying, Robinhood halted trading on GameStop, explaining that they had to restrict buying in order to meet their requirements as a broker. “I was upset at the time, but my lesson learned of not trying to get into a stock or trade [for fear of missing out] has served me better over the past month and a half,” said Rohan Varma (12).

March 8, 2021

Keith Gill, dubbed “Roaring Kitty” on social media, started the fire.

“A few things I am not. I am not a cat. I am not an institutional investor. Nor am I a hedge fund. I’m just an individual whose investment in GameStop and posts on social media were based upon my own research and analysis,” Gill, the instigator of an investing anomaly that sparked varied emotions in traders throughout the financial world, said during a hearing held by the House Financial Services Committee, alluding to another well-known incident in which a lawyer could not turn off a cat filter during a virtual hearing.

Following the GameStop short squeeze last month when stock prices rose exponentially, forcing investors to buy shares they had already sold back at higher prices, the House Financial Services Committee held the first of a series of hearings on Feb. 18, interrogating the major proponents of the incident: Robinhood CEO Vlad Tenev, Citadel CEO Ken Griffin, Melvin Capital CEO Gabriel Plotkin, Reddit co-founder Steve Huffman and Gill.

The hearing investigated the exchange of information between short sellers and investors through social media and determined whether laws are required to regulate such interactions.

The process of shorting involves selling stocks that one does not actually possess and then entering into an obligation to buy them back after a period of time, ideally at a lower price and making the difference (minus taxes) in profit. On Jan. 21, the hedge funds Melvin Capital and Citron Research shorted stocks of AMC Entertainment, BlackBerry, Nokia and the video game company GameStop, predicting the stocks’ prices would drop.

“A number of large hedge fund investors were shorting GameStop because it displayed the characteristics of an outdated brick-and-mortar sales system, whose business had mostly gone digital,” said upper school economics teacher Damon Halback. “This desire to short GameStop was excessively exacerbated by the pandemic.”

Aware of the hedge funds’ intentions, a group of Redditors on the subreddit channel r/wallstreetbets encouraged their audience to buy GameStop stock (GME) in order to raise the price of each share.

“r/wallstreetbets believed that they could create a short squeeze through collective action,” Halback said. “In the process, they would accomplish a number of things: stick it to Wall Street hedge fund managers, support a company whose nostalgic ties they wanted to revel in and make money.”

To buy GME stocks, many Redditors took to the financial services app Robinhood, which allows users to invest in stocks, options and funds. The increase in buying caused the stock price to rise exponentially, forcing the hedge funds to buy the stocks back at prices higher than the original prices at which they sold.

On Jan. 21, GME’s price was $43.03, and on Jan. 27, the stock reached a high of $347.51. In doing so, the Redditors who invested early made money while the hedge funds Melvin and Citron faced losses in large amounts. Although the exact amount of their losses remain unknown, Andrew Left of Citron Research stated in a YouTube video that they faced “a loss, 100%.”

“Citron capital is just fine. We covered a majority of the short in the $90s. I have respect for r/wallstreetbets and the people on the Reddit message boards,” Left said in the video. “Before there was Reddit, there was Citron Research. We were the voice of the individual investor against the institution. So, obviously I support any opposing opinions.”

At the pinnacle of Redditors’ buying, Robinhood halted trading on GameStop, explaining that they had to restrict buying in order to meet their requirements as a broker. Thus, the surging price of GameStop faltered, allowing hedge funds to buy their shares back at prices lower than if trading had been allowed to continue.

Through the financial services company E-Trade, Rohan Varma (12) invested in GME early on after joining the r/wallstreetbets community and researching the stock extensively. Rohan’s trade strategy had two stages.

Towards the end of January, Rohan bought a few shares of the stock and sold them rapidly for a quick profit. Rohan invested again recently, buying GME shares before the stock price spiked again, and he “took home 900% returns.” Although his GME trades did not coincide with Robinhood’s decision to freeze trading, the company’s actions did affect one of his other stocks.

“Robinhood’s decision clearly had an impact on the stock price. Whether intentionally done or not, this decision caused a dramatic and rapid drop in the price,” Rohan said. “I had a significant amount of money invested in AMC, one of the stocks halted by this decision, and lost a very good chunk of it. I was upset at the time, but my lesson learned of not trying to get into a stock or trade [for fear of missing out] has served me better over the past month and a half.”

Robinhood’s mission is to bring investing to all, no matter one’s socioeconomic status. In suspending the trade of Gamestop stock, small scale investors felt that the company was siding with the hedge funds by helping them cut their losses, leading to some individuals filing lawsuits. Furthermore, many investors decided to buy GME stock at its peak, expecting it to become worth even more, and were disappointed as the stock fell drastically after Jan. 29.

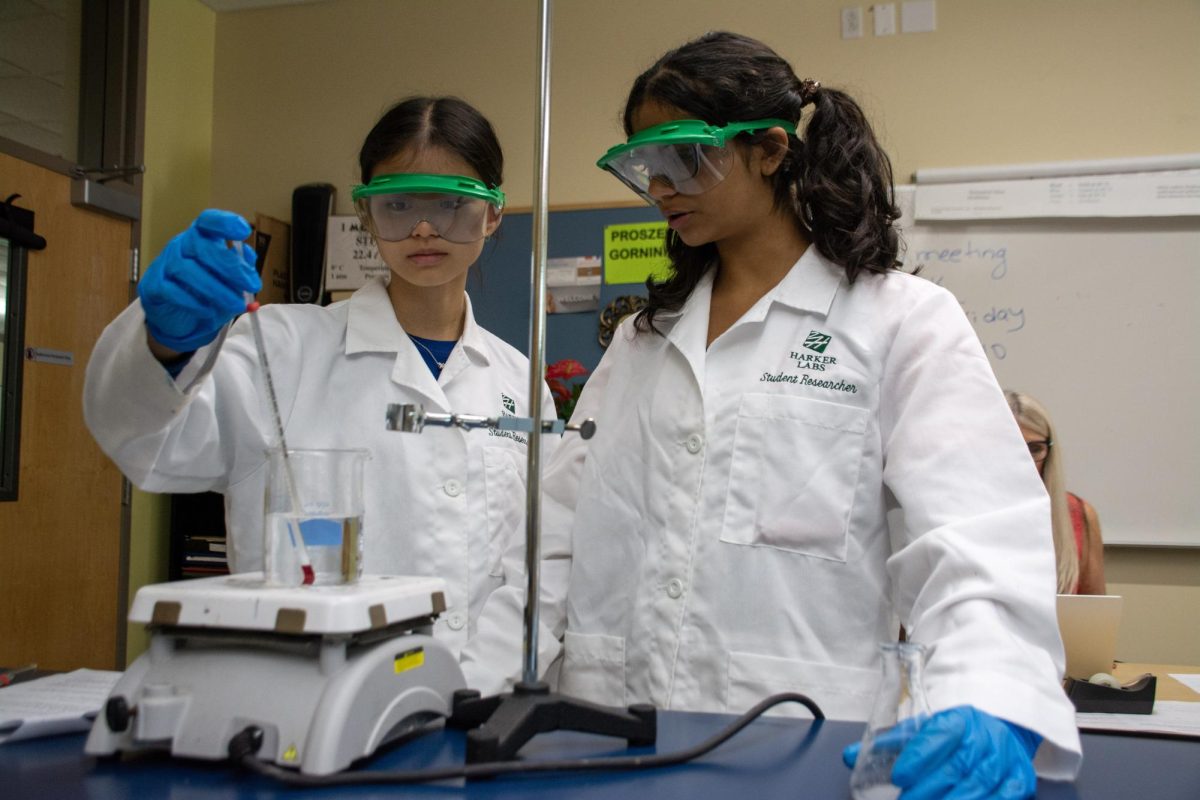

“There were plenty of small investors that lost money as well. So many people were investing for the first time on this overpriced volatile stock, not understanding that eventually its value would crash,” Trisha Variyar (10), co-CEO of the Harker Investment Club, said. “There is a certain point where investing just becomes glorified gambling, and I believe that any novice investor that bought GameStop crossed that threshold.”

The class action lawsuit seeks to gain monetary relief as the plaintiffs believe they were “stripped of the rights to control their investments due to a large, overarching conspiracy to prevent the market from operating freely.” In the wake of these reactions, the House Financial Services Committee plans to continue investigating the situation before making concrete decisions on how to regulate those involved in the incident.

Upper school students interested in trading have been investing using a variety of different applications including E-Trade, Ameritrade and Robinhood, gaining experience in the world of stocks.

By observing situations like the GameStop incident, students are able to devise strategies that they can then apply to their own financial decisions. While there are risks associated with spending real money, students can turn investing into a valuable experience as they can learn from their own mistakes and improve.

“Never think about how much money you could have made: ‘If I had bought this, then I would have made x%.’ Never let those thoughts control you,” Vayun Tiwari (11), who has been investing using Ameritrade since eighth grade, said. “Treat right now as a learning experience and make note of your mistakes, so that when you begin to earn income and invest more, you know what to do.”

![LALC Vice President of External Affairs Raeanne Li (11) explains the International Phonetic Alphabet to attendees. "We decided to have more fun topics this year instead of just talking about the same things every year so our older members can also [enjoy],” Raeanne said.](https://harkeraquila.com/wp-content/uploads/2025/10/DSC_4627-1200x795.jpg)

![“[Building nerf blasters] became this outlet of creativity for me that hasn't been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but I've had to learn from [the skills needed from] soldering to proper painting. There's so many different options for everything, if you think about it, it exists. The best part is [that] if it doesn't exist, you can build it yourself," Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and it's played such a major role in who I've become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something I'm [really] proud of,” Anvitha Tummala ('21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you aren't going to get those championships if you aren't fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

![“I'm not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that there's a lot of people that are really confident in what they do, and I really admire them. Everyone's so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)

![At the pinnacle of Redditors’ buying, Robinhood halted trading on GameStop, explaining that they had to restrict buying in order to meet their requirements as a broker. "I was upset at the time, but my lesson learned of not trying to get into a stock or trade [for fear of missing out] has served me better over the past month and a half," said Rohan Varma (12).](https://harkeraquila.com/wp-content/uploads/2021/03/156914928_186003909668760_1161010688259299454_n.jpg)