Indian government demonetizes 500- and 1,000- rupee notes

Courtesy of Wikimedia Commons

People at a bank line up to exchange or deposit their 500 and 1,000 rupee notes. People are limited to withdrawing 2,000 rupees in cash each week.

January 24, 2017

The Indian federal government demonetized all 500- and 1,000-rupee notes on Nov. 8, 2016. Prime Minister Narendra Modi declared that the notes would cease to be effective on Nov. 9, leading to a short-term drop in sales and the Indian economy that could have global impacts.

The decision has impacted over one billion people that live in the country. The banknotes accounted for approximately 85 percent of the Indian currency in circulation. 500 rupees is around $7.50, while 1000 rupees is around $15.

“Short-term, people are losing an immediate purchase power, because the government has [limited people to drawing] 2,000 rupees in cash from ATMs. That means, in a week, a person can only spend 2,000 rupees in cash,” said Dinakara Rao Pasupuleti, former chief general manager of the State Bank of Hyderabad in India. “Most of the middle-class people in the Indian economy depend on cash for the purchase of small goods. Therefore, in a month, they cannot spend more than 12,000 rupees, so, in the short term, purchase sales will decline.”

By doing so, the government attempted to reduce the use of the black market system. 500- and 1,000-rupee notes have played a major role in financing terrorism and drug exchanges. Illegal activities including gambling and illicit liquor brewing also depend on black money and have been suppressed due to the demonetization.

The government also intended to digitize more transactions in India and motivate residents to set up bank accounts by reducing the availability of cash.

“I do think people who possess fewer financial resources will find that devalued currency might make it harder for them to borrow and be as successful in lower-level economic activities and opportunities,” economics and Modern International Affairs teacher Damon Halback said. “It’s going to make the currency stronger, so I think there’s going to be a short-term pain, but that pain’s going to be felt asymmetrically.”

The country’s cash-dependent economy suffered a severe decline after the decision was made. Over 90 percent of transactions that take place in India are made through cash, and most vendors can only accept payment through cash. Transactions through the app Uber occur through cash in India.

The price of real estate is expected to drop as a result of the demonetization. Prior to the demonetization, certain parts of the country paid for property with both official and unofficial money.

Demonetizing currency has not yet achieved all of the goals Modi wanted it to.

“I don’t think it will eliminate [black market exchanges and terrorism], but is it a way to mitigate the impact of those issues? I do think so,” Halback said. “By making it harder to make illegal exchanges, it mitigates the problem, but it doesn’t solve the problem whatsoever; it’s a short-term mitigation.”

Sales in India have severely declined because citizens can no longer make small transactions, since many purchases occur through cash and small vendors do not have the means to accept digital transactions.

According to The New York Times, India’s economic growth slowed to a rate of 7.1 percent, lower than its growth of 7.6 percent as of March in 2016, because of the demonetization. The projected the growth rate is expected to drop even more within the beginning of 2017 to around 6.3 or 6.4 percent.

This piece was originally published in the pages of The Winged Post on January 24, 2017.

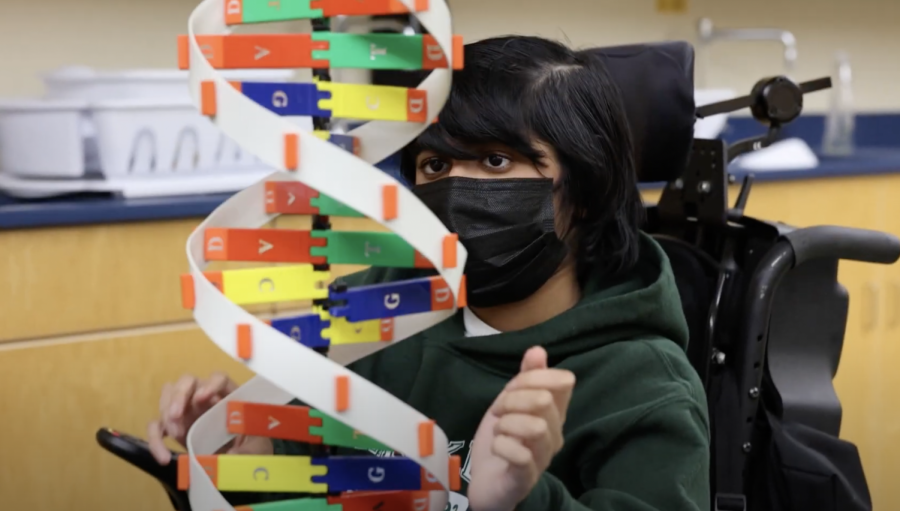

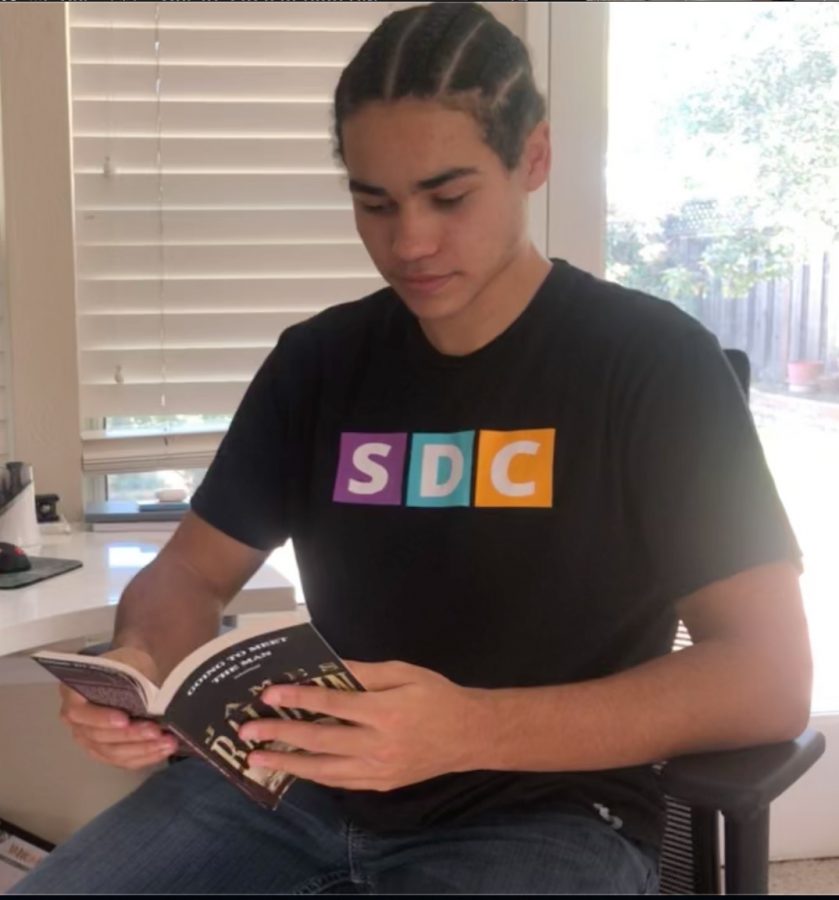

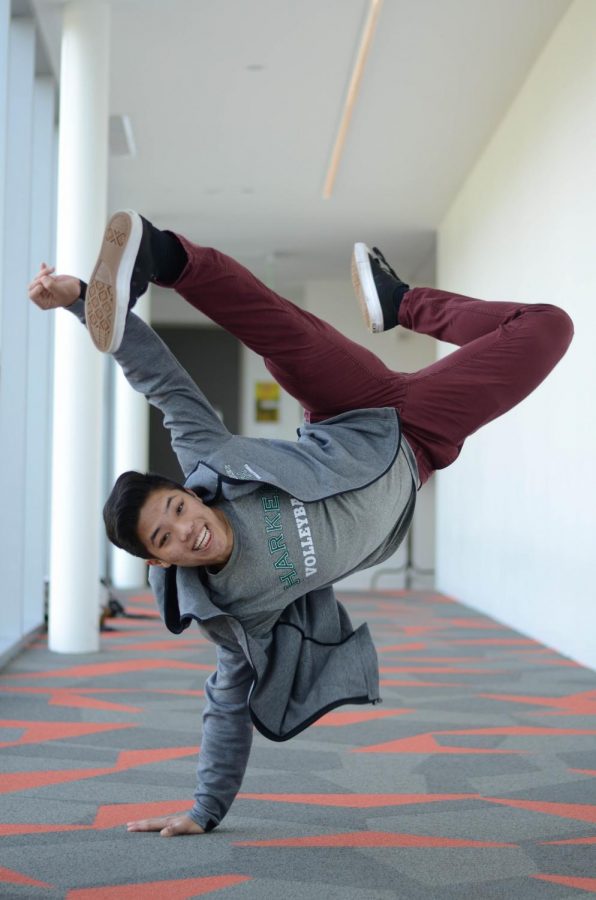

![“[Building nerf blasters] became this outlet of creativity for me that hasn't been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but I've had to learn from [the skills needed from] soldering to proper painting. There's so many different options for everything, if you think about it, it exists. The best part is [that] if it doesn't exist, you can build it yourself," Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and it's played such a major role in who I've become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something I'm [really] proud of,” Anvitha Tummala ('21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you aren't going to get those championships if you aren't fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

![“I'm not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that there's a lot of people that are really confident in what they do, and I really admire them. Everyone's so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)