President Donald Trump has vowed to impose sweeping 25% tariffs on Mexico and Canada to take effect on Tuesday, part of a broader wave of tariffs he has implemented or threatened on major U.S. trading partners, industries and adversaries since January.

While the administration argues that taxing foreign imports will protect American industries and address trade imbalances, many are concerned about rising prices for consumers and businesses.

“The biggest thing about tariffs is just like any other tax, they raise costs,” economics teacher Samuel Lepler said. “When you tariff inputs like steel or lumber, or things that go into making a lot of different things, it both reduces the quantity that we get and also raises prices. It’s very inflationary.”

The tariffs on Canada and Mexico carry significant political implications, with the administration using them as leverage to pressure both countries to take stronger action on preventing illegal immigration and fentanyl tracking to the U.S. Although the tariffs were initially imposed in early February, Trump agreed to a 30-day pause after both countries promised to address U.S. concerns.

“[The Canada and Mexico tariffs] aren’t so much of an economic barrier, but more of a threat,” Economic Club officer Leana Zhou said. “It’s like, ‘if you don’t try to do more to stop the flow of illegal immigrants and drugs, then I’m going to put down tariffs, which is gonna make sure that US citizens stop buying your stuff,’ and they need that money for the GDP. To prevent the tariffs, that’s when they start agreeing to US demands.”

The possibility of a trade war raises concerns about higher prices on groceries, car and gas prices and construction materials, all products traded through North America.

Beyond North America, Trump’s trade policies have also intensified economic tensions with China. His tariff on Chinese imports, which went into effect on Feb. 2, will have an enormoousimpact on the economy. The vast number of Chinese-made products in the U.S. market means that prices of traditionally low-cost items like shoes, kitchen items and furniture, will rise if tariffs persist. Electronics like cell phones and laptops make up a large part of Chinese imports and will also be affected.

“Most of our outdoor gear, clothing we sell are all imported from countries like China,” local REI employee Tara said. “We haven’t seen prices change yet, but people are definitely concerned about these products becoming more expensive, and that could reflect on the prices our customers see.”

Popular Chinese retailers like Shein, Temu and AliExpress previously took advantage of a loophole that allowed foreign goods under $800 to enter the U.S. without customs duties. Trump’s economic orders against China will halt this exemption, preventing Chinese companies from flooding the U.S. market with ultra-low-cost products.

The U.S. and China have a complex trade relationship marked by tensions over trade imbalance. Leana notes that this history, and Trump’s longstanding opposition to China’s trade practices, plays a large role in his decision to implement new tariffs.

“China is known for their cheap labor and driving the US out of competition,” Leana said. “The reasoning is that because China makes a lot of cheap stuff, US markets are less motivated to put in their own investments, which could negatively impact the economy or GDP. By putting down the tariffs, he’s trying to protect domestic markets.”

In addition to tariffs on specific countries, Trump has promised taxes on select products like all steel and aluminum imports, as well as retaliatory tariffs to match the import tax rates set on other countries. With these, Trump aims to reduce trade imbalances and boost the competitiveness of U.S manufacturers against foreign rivals.

“If we see the prices of all these building materials go way up, that will make the process of creating infrastructure like new factories much harder,” Leana said. “That makes it more difficult to boost these American industries, which was the whole point of tariffs in the first place.”

Much of Trump’s tariff policy is a direct appeal to a key segment of his voter base, particularly in manufacturing-heavy states like Ohio, Pennsylvania and Michigan. These regions have been economically strained for decades due to decades of the U.S. economy becoming increasingly specialized in high-skill industries like technology, while lower-skill manufacturing jobs have been outsourced.

“That [increasing skill divide] has led to a bifurcation of income, which helped Silicon Valley become massively wealthy, but the areas that are really big manufacturing hubs have been hit very hard by this since the 1970s through to today,” Lepler said. “There’s a lot of anger there, and there’s a lot of ‘the economy is working for everybody but me’ type of mindset. It’s not fictional; it’s real, and Trump really tapped into that.”

As Trump’s administration moves beyond its first month, the complexities of the tariffs and their economic and political stakes are clear. While their full impact remains uncertain, Lepler suggests that they might not be as significant as many anticipate.

“There are many people that disagree when you’re predicting the future, but I truly do believe a lot of it is for show, as opposed to actual real intended economic policy,” Lepler said. “Trump’s style is he needs to appear strong, he needs to appear to be keeping his promises, he needs to appear to be a force to be reckoned with. But in terms of actually putting in place policies that might really be deleterious to the economy, I’m very skeptical.”

![“[Building nerf blasters] became this outlet of creativity for me that hasn't been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but I've had to learn from [the skills needed from] soldering to proper painting. There's so many different options for everything, if you think about it, it exists. The best part is [that] if it doesn't exist, you can build it yourself," Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and it's played such a major role in who I've become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something I'm [really] proud of,” Anvitha Tummala ('21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you aren't going to get those championships if you aren't fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

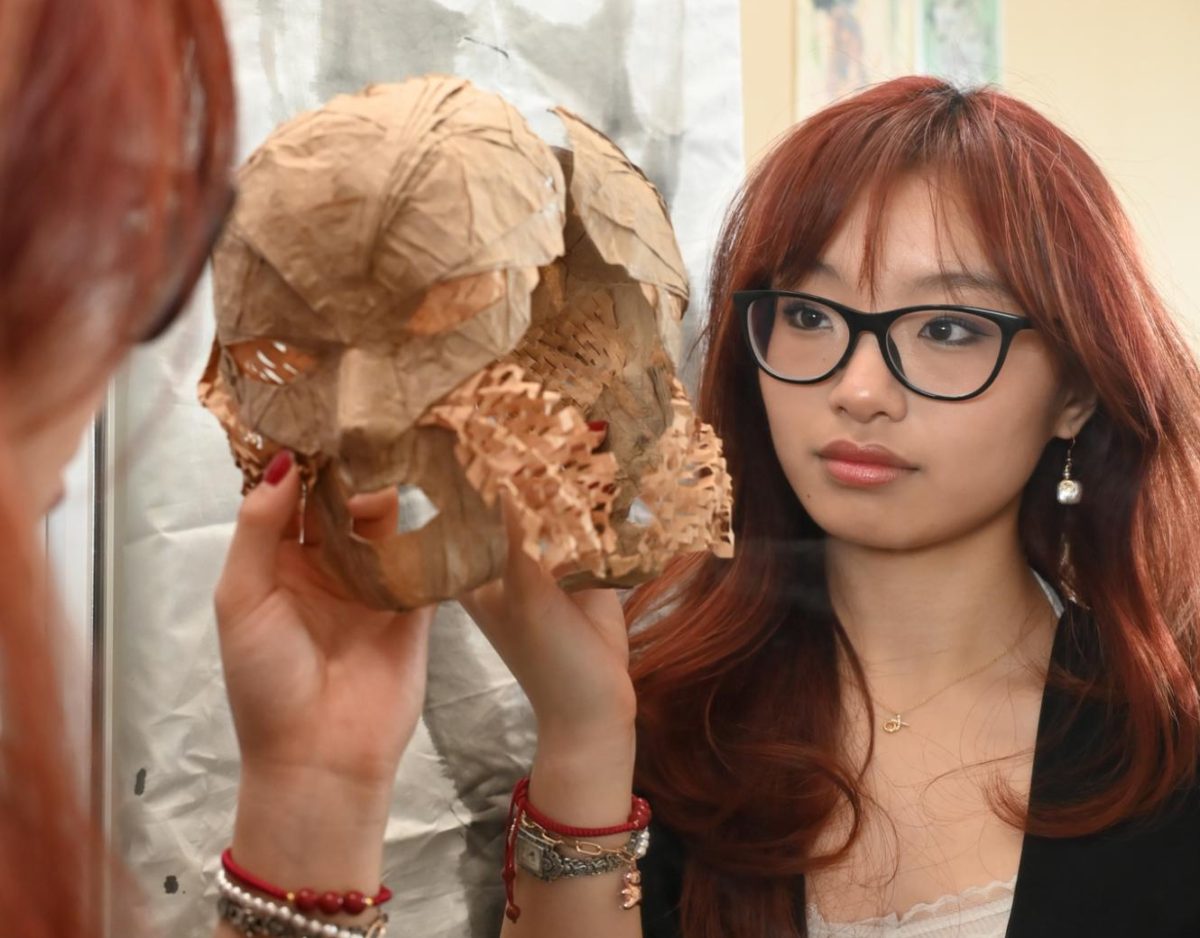

![“I'm not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that there's a lot of people that are really confident in what they do, and I really admire them. Everyone's so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)

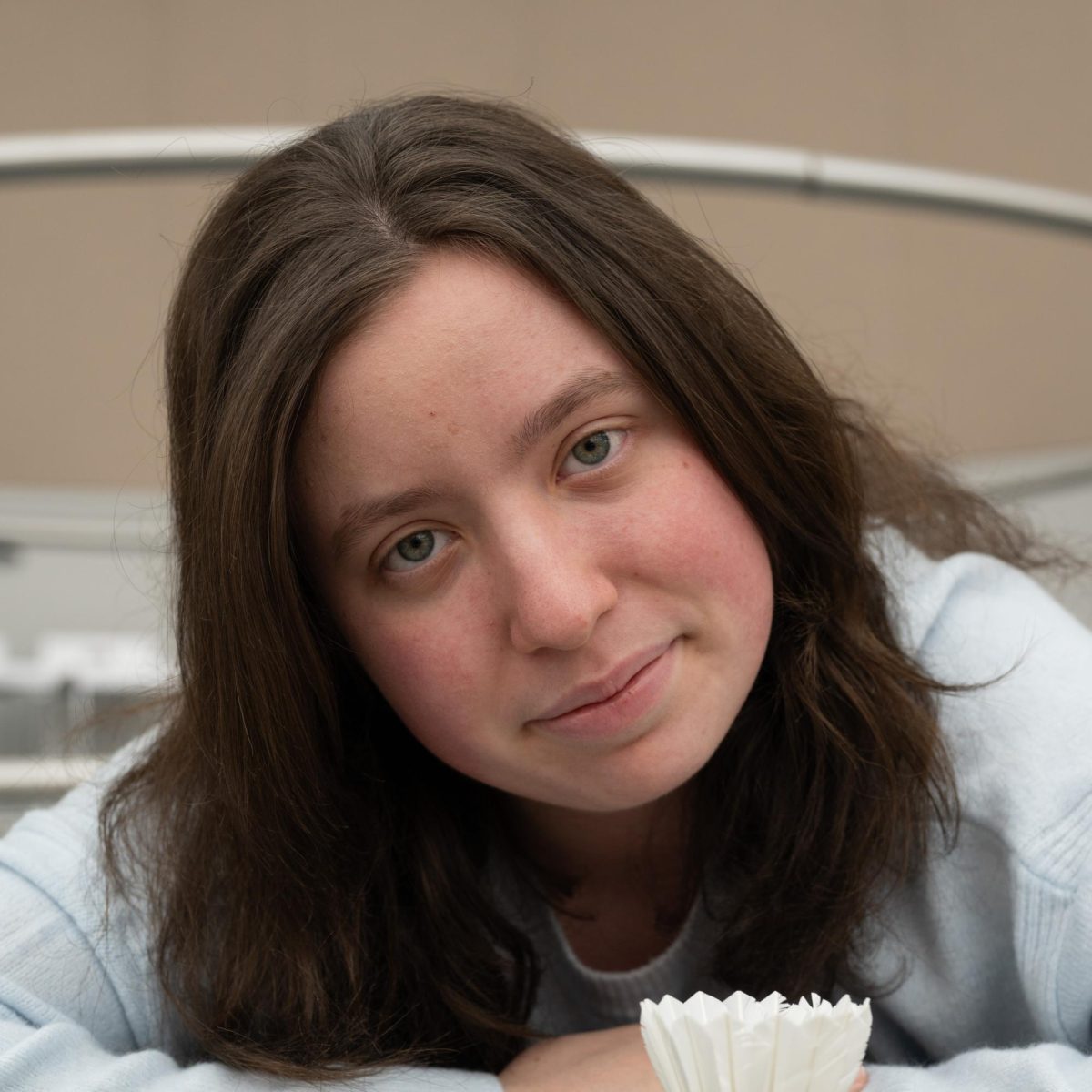

![LALC Vice President of External Affairs Raeanne Li (11) explains the International Phonetic Alphabet to attendees. "We decided to have more fun topics this year instead of just talking about the same things every year so our older members can also [enjoy],” Raeanne said.](https://harkeraquila.com/wp-content/uploads/2025/10/DSC_4627-1200x795.jpg)