Big-name presidential candidates and rising political stars often flood the airwaves and capture voters’ attention across California during election season, overshadowing one of the Golden State’s most important policy-making tools: the proposition system.

Propositions serve as one of the few forms of direct democracy available to voters: ballot measures are suggested by citizens, approved by the state attorney general, converted into a petition that requires a certain amount of signatures — 874,641 this year — and then finally placed on the ballot. On Nov. 5 from 7 a.m. to 8 p.m., voters will mark “Yes” or “No” to? each proposition.

Here’s a breakdown of every ballot measure available for California voters this year:

Proposition 2: School Bonds

What you need to know: This proposition would allocate $10 billion for improvements in California public schools, community colleges and career technical education institutes. The state would borrow the money needed for these infrastructure improvements, increasing the state bond obligation significantly.

Why does this matter? Legislative Democrats argue that public schools of all kinds are in need of significant improvements to serve the community properly, while legislative Republicans argue the price of the measure outweighs the benefits, projecting an estimated extra $18 billion of taxpayer costs. The choice of education versus cost control will challenge California’s families balancing their children’s future with potential economic stability.

Proposition 3: Enshrining Same-Sex Marriage

What you need to know: This measure changes language in California’s state constitution to remove diction that makes reference to the gender or race of potential married couples. Specifically, it removes references to marriage as undertaken by a man and a woman. The motion comes at no cost to taxpayers and serves as a purely symbolic act.

Why does this matter? This measure upholds the idea of marriage as an inalienable right for all Californians, regardless of sexual orientation. It shifts the constitution in language only, making the law equitably represent all Californians. Opponents say that the proposition would change the language of the state constitution to allow child marriages, incest and polygamy, an argument which has no factual or legal basis.

Proposition 4: Natural Resources Bonds

What you need to know: Similar to Prop 2, the measure would allow for the state to borrow $10 billion to rectify the effects of climate change, with $1.9 billion going to improve drinking water, largely in lower-income communities, and the rest to other climate-related programs like preventing wildfires and restoring forests. The bill would cost taxpayers $16 billion total, to the tune of $400 million a year for 40 years.

Why does this matter? Firefighters and environmental groups back this proposition as an important step towards climate action in California. Taxpayer organizations and conservative legislators oppose this measure because of its price tag and its use of bonds, which comes at a significantly more expensive cost to Californians than use of the state budget.

Proposition 5: Local Government Funding for Housing

What you need to know: This proposition would make it easier for local governments to acquire bonds that support housing for low to middle income Californians. Presently, California requires a two-thirds approval from local electorates to approve housing bonds. This bill could lower that requirement to 55%. The bonds would be required to fund affordable housing and public infrastructure on the local level.

Why does this matter? Major opposition to this motion again comes from taxpayer interest groups and the conservative legislators, who oppose the use of bonds as a means of debt spending. Proponents of the bill, including the League of Women Voters, affordable housing organizations and the California Democratic Party, support it for its benefit to groups like single mothers and working families.

Proposition 6: Eliminating slavery in prisons

What you need to know: Like in many states, inmates in California prisons perform manual labor as part of prisons’ general rehabilitation system and work programs. Any prisoner who refuses work risks punishment or retaliation from prison officials, something deemed inhumane and outlawed by multiple states. This measure would ban both of these practices, allowing inmates to choose if and when they work.

Why does this matter? “Indentured servitude,” the official definition for this type of labor, represents the last vestige of slavery allowed in the United States. Groups ranging from civil rights organizations to Democratic lawmakers support the banning of forced work in state prisons. No official counter argument to the California prop was submitted, although some critics from states that imposed similar measures believe allowing prisoners to refuse work makes running prisons more difficult.

Proposition 32: Raising the minimum wage

What you need to know: This proposition raises the minimum wage to $17 in 2025 and $18 in 2026 for most businesses, delaying the process by a year for ones with less than 25 employees. The fiscal impact of this measure on state governments remains unknown, with a potential increase or decrease in revenues based on the results of the bill’s passing.

Why this matters: For labor groups and the larger swathe of progressive interest groups and lawmakers, this measure comes as a too-little, too-late concession to raise the baseline for what workers can get paid. With that being said, they still support the measure on a something-better-than-nothing basis. Opposition to this measure comes from business and conservative groups, who argue that the supposed bounce back from COVID has not happened for business of all kinds, disallowing any ability to raise the baseline for now.

Proposition 33: Expanding rent control

What you need to know: This measure repeals the Costa-Hawkins Rental Housing Act of 1995, which limits the practice of rent control. Rent control allows state governments to cap rental prices of properties. This issue has long proven to be controversial, as it deals with a nuanced economic issue that often splits typical party and legislative coalitions. This motion comes at a time when about 30% of Californians spend over half their income on rent, marking a significant economic issue?.

Why this matters: Supporters of the motion say that rent control allows for governments to crack down on predatory behaviors by landlords, therefore making rent more affordable for all potential tenants. The opposition to this proposition includes landlords, but many progressive interest groups and affordable housing enthusiasts also oppose repealing the old law. This portion of the dissenting coalition says that incentive to build new housing is greatly reduced by rent control, therefore driving up existing units’ prices and worsening the housing issue for Californians.

Proposition 34: Requiring prescription drug revenue to go to patients

What you need to know: Health care providers that serve low income groups have long been sold discounted pharmaceuticals, which allows for extra profit when said providers sell them at retail price. The general idea surrounding this practice holds these providers to the standard that they should use the extra profit to expand health care to even more disadvantaged patients, thereby creating a positive feedback loop. This proposition would strengthen the guarantee that minimum 98% of these extra profits go to patients, at the risk of losing government benefits if they do not fulfill these goals.

This measure in particular, though, comes amid accusations of the entire proposition being a political hit job. The fine print means it would only apply to one provider, run by a controversial California political figure named Michael Weinstein, who has opposed affordable housing with massive sums of money. As such, opponents of this measure have accused its supporters of writing it exclusively to get back at Weinstein, as a number of housing interest groups have promoted it.

Why this matters: The most complicated and politically delicate measure of this cycle, Prop 34 could benefit patients, especially those from lower-income backgrounds. More likely than not, though, whether it passes or fails, it will end up in court as a result of its muddled political background

Proposition 35: Allocating of health care insurance tax money for Medi-Cal health care services

What you need to know: Medi-Cal is a subsidized insurance plan that serves millions of low-income Californians. After years of expansion due to lowered eligibility requirements, the doctors that are purportedly incentivized to participate in the plan have not received any meaningful pay increase. This measure seeks to rectify that, increasing taxpayer costs as a boon to the incentive pool for doctors, further strengthening the treatment program.

Why does this matter? Proponents of Prop 35 say it could provide a much-needed boost to the healthcare system, fixing the issue of doctors not wanting to participate in Medi-Cal due to its relatively low and stagnant benefit. Obviously, the cost of this measure leaves some conservative lawmakers and taxpayer groups unconvinced by its merit. Interestingly, though, its main opposition comes from small delegations of healthcare activists who argue the short-term benefits of the taxpayer money could come at the expense of millions in future federal funding, as Prop 35 would lower the correlatory tax that the federal government matches.

Proposition 36: Increasing punishments for certain drug and theft crimes

What you need to know: This measure means that certain incidents of drug crimes or theft under $950, which are currently classified as misdemeanors, could result in felony charges, given that the perpetrator has two or more previous drug or theft convictions. Prop 36 would undo some of the changes implemented in 2014’s Prop 47, which reclassified many drug possession and theft offenses from felonies to misdemeanors, excepting perpetrators with prior convictions. To both local and state courts, felony cases are both more time and resource-intensive than misdemeanor cases, so Prop 36 would increase courts’ workload and spendings. In parallel, though, Prop 36 would also reduce state spendings on mental health care, drug rehabilitation and other services.

Why does this matter? Prop 36’s proposed increase in felony reclassifications would change the way California looks at drug and theft offenses. The extended sentences and harsher punishments associated with this proposition are supported by a broad swathe of retailers, taxpayer interest organizations and conservative lawmakers, who believe the measure serves as a compromise that can help address homelessness and the opioid epidemic while still being tough on crime. Liberal lawmakers oppose the proposition, citing a breadth of knowledge that suggests harsher punishment has no correlation to a reduction in crime.

![“[Building nerf blasters] became this outlet of creativity for me that hasn't been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but I've had to learn from [the skills needed from] soldering to proper painting. There's so many different options for everything, if you think about it, it exists. The best part is [that] if it doesn't exist, you can build it yourself," Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and it's played such a major role in who I've become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something I'm [really] proud of,” Anvitha Tummala ('21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you aren't going to get those championships if you aren't fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

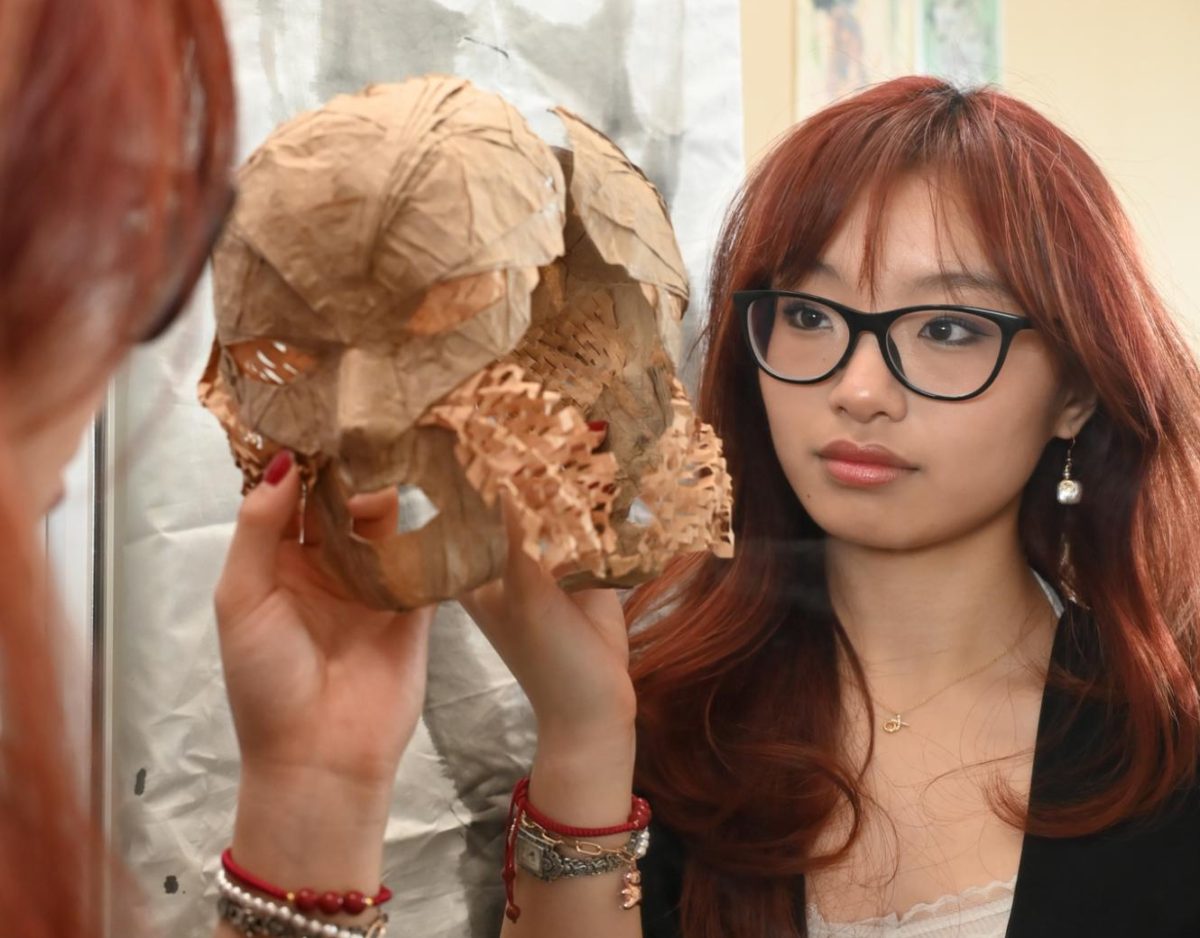

![“I'm not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that there's a lot of people that are really confident in what they do, and I really admire them. Everyone's so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)

![LALC Vice President of External Affairs Raeanne Li (11) explains the International Phonetic Alphabet to attendees. "We decided to have more fun topics this year instead of just talking about the same things every year so our older members can also [enjoy],” Raeanne said.](https://harkeraquila.com/wp-content/uploads/2025/10/DSC_4627-1200x795.jpg)