Monopolizing the airwaves

AT&T and Time Warner merger limits consumer media choice

November 21, 2016

AT&T, a multinational telecommunications conglomerate and America’s second largest cell phone carrier, announced its blockbuster plans to acquire Time Warner for $85.4 billion on Oct. 22. This deal would allow AT&T to gain control of TV networks such as HBO, CNN, TNT and Warner Bros. Studios.

As customers increasingly move away from cable networks in favor of subscriptions to streaming services, AT&T hopes that this acquisition of Time Warner will help sustain its business and support its growth.

However, a merger between such a large content distributor and such a powerful content creator can create problems for consumers. This combination of companies would allow AT&T the power to control distribution—such as when AT&T acquired DirecTV in 2014 and limited access to certain channel providers. The same situation could occur with Time Warner’s material and its limits on competitors’ content. We have already seen a precedent for restrictions, when Verizon paid for access to NFL games for its subscribers and denied access to those on AT&T’s network.

AT&T’s power in the internet industry makes the merger of Time Warner and AT&T very dangerous, especially for consumers. In fact, AT&T is in control of large portions of the country’s internet, so it has the power to manipulate its own internet service to give privileges to companies allied with Time Warner.

The merger’s potential control over internet and the growth of streaming services make the merger even scarier. The company could give preferential treatment by excluding Time Warner content from its data limits. Such unlimited data access can hurt other large media networks like Netflix and Amazon, as well as smaller companies and start-ups.

In a competitive environment, content creators have leverage in the negotiation process, which allows them to pitch more unique or controversial content. Independently-minded satirical shows such as Saturday Night Live and the Simpsons, would potentially lose their freedom to express their views in a post-merger environment.

AT&T could also either refuse other companies the right to air their content or charge hefty fees to do so. Limiting certain content to specific networks limits consumer freedom. Imagine if AT&T limited HBO content to only its mobile network. Such forms of censorship by omission deviate from the optimal experience.

Mergers like these lead to a concentration of power amongst the few, which limits competition and eventually leads to higher prices. Competition is needed to create more creative products at a better value. Without it, all consumers lose.

Vertical integrations of companies like these are unions of businesses that are not in direct competition and therefore are not considered to be in violation of federal laws regarding the creation of monopolies.

However, anti-trust and monopoly laws should allow the government to prevent such vertical mergers from occurring. If the merger is approved, the creators of media content will not have any authority over the use of their products and will instead be controlled by an entity powerful enough to control not just shows and movies but the very pipeline of the internet.

While AT&T anticipates approval by the end of 2017, the deal is attracting protest from consumers, lawmakers and business analysts and will be under formal review by the Department of Justice. The government should place the consumer first and carefully evaluate the potential for antitrust violations and the increasingly monopolistic tendencies of the industry.

This piece was originally published in the pages of The Winged Post on October 11, 2016.

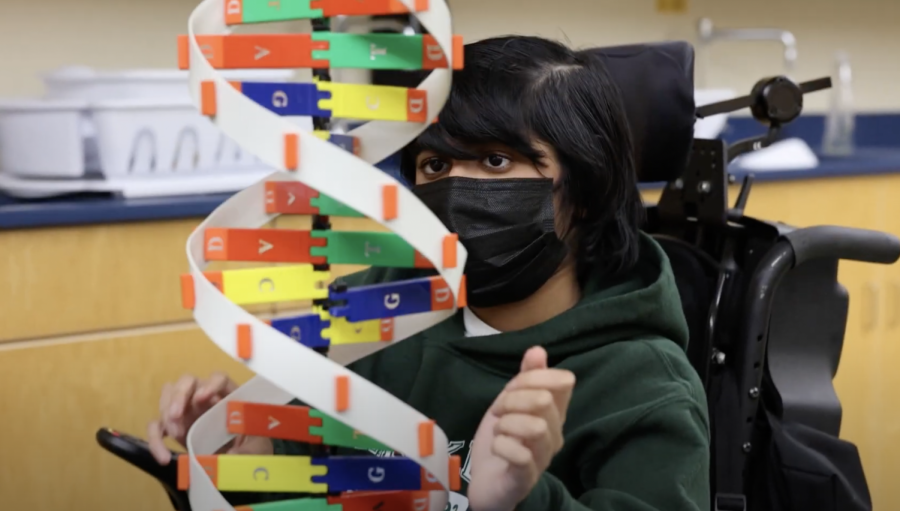

![“[Building nerf blasters] became this outlet of creativity for me that hasn't been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but I've had to learn from [the skills needed from] soldering to proper painting. There's so many different options for everything, if you think about it, it exists. The best part is [that] if it doesn't exist, you can build it yourself," Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and it's played such a major role in who I've become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something I'm [really] proud of,” Anvitha Tummala ('21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)

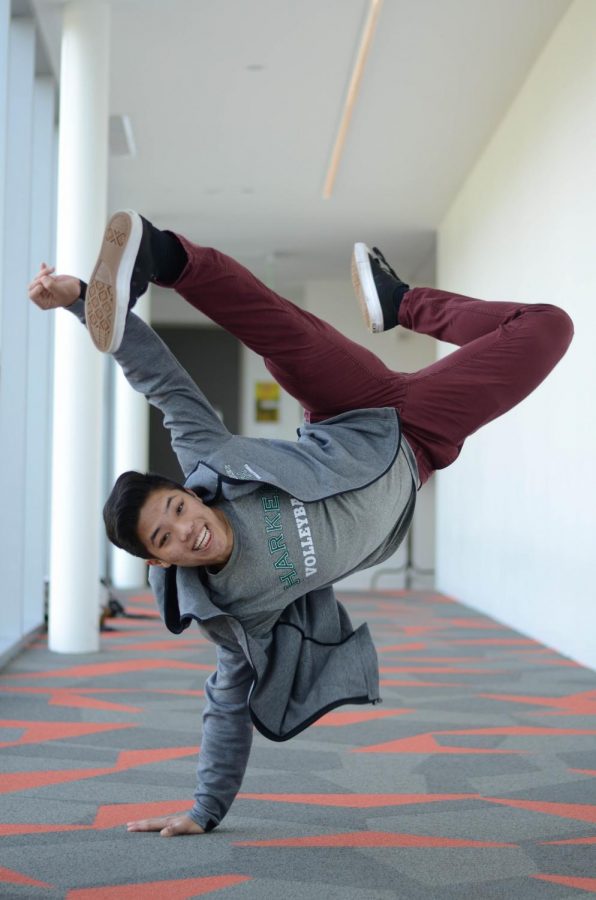

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you aren't going to get those championships if you aren't fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

![“I'm not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that there's a lot of people that are really confident in what they do, and I really admire them. Everyone's so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)