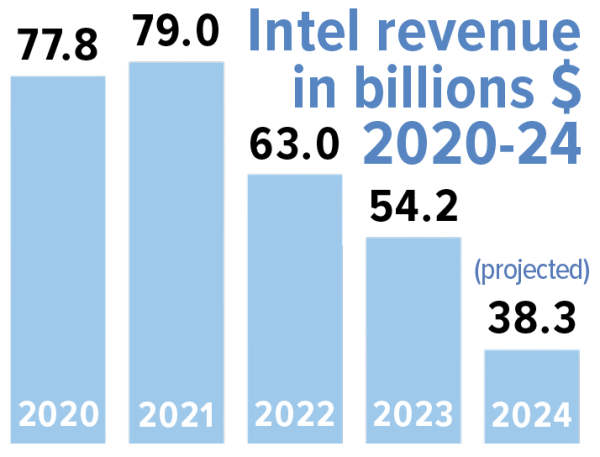

Intel’s stock plummeted over 40% this past month, marking its worst fall in 50 years. The company’s per-share price tanked 26% just a day after it announced a $10 billion cost-cutting plan in its second-quarter report on Aug. 1. Measures taken included slashing dividends and laying off 15% of employees. These developments come as a major setback for the Silicon Valley-based company as it struggles to maintain its dominant position in the semiconductor industry.

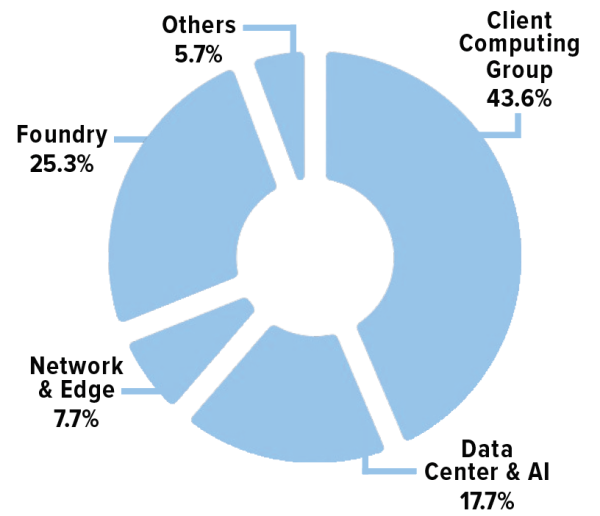

Once a global leader in chip manufacturing, Intel has steadily lagged behind competitors like NVIDIA and Advanced Micro Devices (AMD) for the last few years. Technologically, the company is fighting an uphill battle. They specialize in producing central processing units (CPUs), the component in a computer which is responsible for performing calculations. But in recent years, CPUs have faded out of focus, eclipsed by the graphics processing unit (GPU), which offers more processing power due to its unique ability to execute computations in parallel.

“A CPU will just do one calculation at a time. A GPU only does one kind of arithmetic, but all the answers come out in parallel,” upper school computer architecture teacher Marina Peregrino said. “If you look at AI, you’re just doing a bunch of linear algebra and matrix operations essentially. So that’s why the GPU is glorious there.”

Upper school economics teacher Samuel Lepler notes how technological shifts have led to the demise of many older companies. He cites renowned economist Joseph Schumpeter’s concept of “creative destruction,” or destroying the old to create the new. For instance, computer software company Hewlett Packard (HP), often recognized as the “founder” of Silicon Valley, once held the top spot as the world’s leading PC manufacturer. Poor leadership and stagnant development led to their downfall.

“I’m not sure Intel is headed for death per se,” Lepler said. “It sounds to me just as an outsider that it’s a similar tech revolution that the new companies that are innovative, nimble and able to adjust to quick trends are able to outperform.”

Throughout the 2000s, Intel missed several opportunities to invest in other prospective markets. In 2006, they turned down an offer to outfit the emerging iPhone with Intel chips, doubting the profitability. Apple’s newer MacBook models, like the M1, M2 and M3, also abandoned Intel’s CPUs in favor of their own line of Apple silicon processors. In 2017, Intel gave up a chance to buy a $1 billion stake in OpenAI, the company behind ChatGPT and other AI models, which was still an early startup at the time. Fast forward to the present, the company tried to capitalize on the GPU trend by releasing their Gaudi 3 AI accelerator, but it hasn’t gained much traction so far. Despite these setbacks, Peregrino believes there’s still time for the company to catch up.

“I don’t think it’s too late for them to get into the GPU market,” Peregrino said. “They have the infrastructure but just have to shift their mindset a little bit. The processes, the manufacturing, it’s pretty much the same. They just have to join the race.”

Over the last couple of years, Intel has received a fair share of assistance from the U.S. government. Congress passed the Chips and Science Act in Aug. 2022 to “support the domestic production of semiconductors,” providing $52 billion to various U.S.-based companies. As one of the biggest chip manufacturers in the country, Intel collected a significant portion of this budget. The Biden administration awarded the company $8.5 billion in government subsidies in 2023 to pay for the construction of new semiconductor factories.

Taking into account this government backing, Investing Club Co-President Ruhan Arora (11) remains optimistic that they can still rebound from their declining revenues and poor profitability.

“The company has a lot of potential to grow with the backings they’re getting,” Ruhan said. “They’re still in a trusted place right now, and the U.S. government is not going to let Intel fall.”

Intel plans to release their next generation Lunar Lake processors later this year, specifically targeted towards enhancing AI performance. By adjusting their strategy, taking more risks and catching up with current trends, Intel may still have hope to recover and move forward.

“Right now, it’s just a wait and watch game,” Ruhan said. “The clock is ticking, and we can only hope that Intel’s next-gen products do something very big for the company.”

![“[Building nerf blasters] became this outlet of creativity for me that hasn't been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but I've had to learn from [the skills needed from] soldering to proper painting. There's so many different options for everything, if you think about it, it exists. The best part is [that] if it doesn't exist, you can build it yourself," Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and it's played such a major role in who I've become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something I'm [really] proud of,” Anvitha Tummala ('21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you aren't going to get those championships if you aren't fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

![“I'm not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that there's a lot of people that are really confident in what they do, and I really admire them. Everyone's so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)