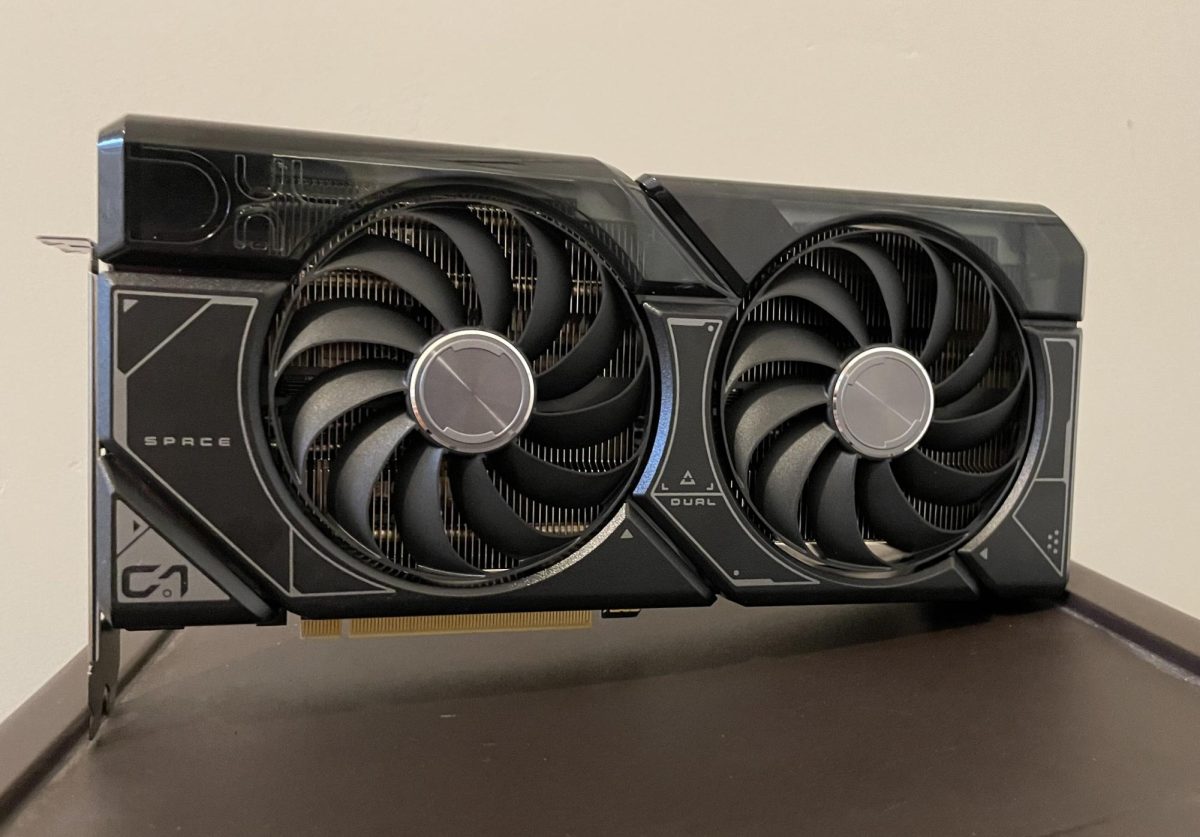

Every year, hundreds of eager buyers flock to Best Buys or constantly refresh online shopping websites, all for one purpose – to get the latest graphics processing unit on launch day. While most casual users incorporate their GPUs into personal PCs for gaming, they serve other purposes as well.

With artificial intelligence rapidly advancing and blockchain soaring in popularity, the demand for processing power has become higher than ever. That’s where GPUs come in, able to train language models and even mine Bitcoin. The need for powerful GPUs is also what drives the success of semiconductor company NVIDIA.

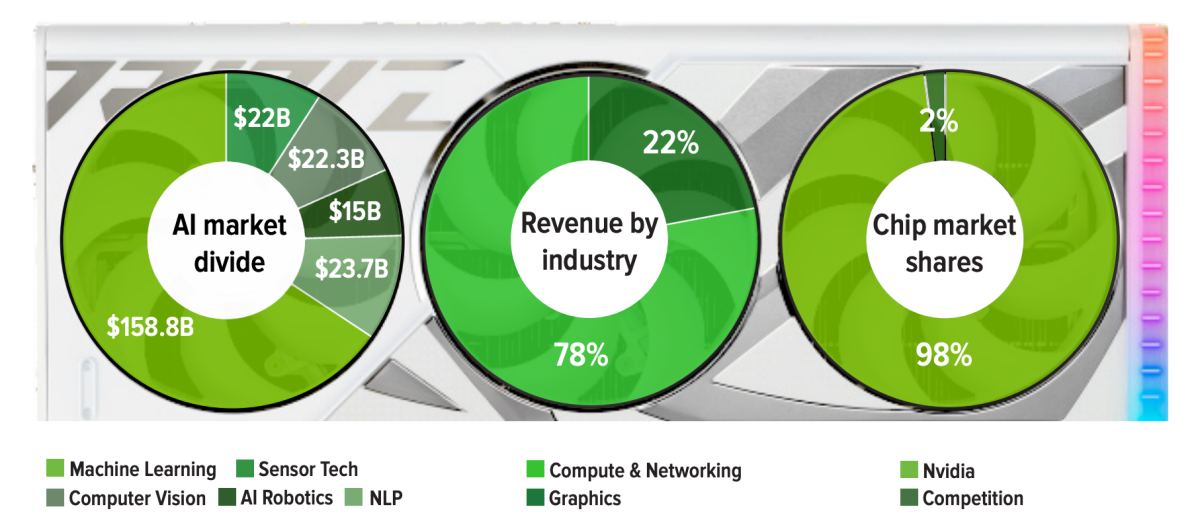

NVIDIA dominates the high-performance GPU market, so they can exert pricing pressure on their customers. Their gross profit margins have risen from just over 60% last January to nearly 80% as of the earnings call on Feb. 21, revealing the extent of their market power.

NVIDIA’s fourth quarter revenue exceeded analyst predictions by over 10 percent, beating Wall Street’s already high expectations for the company. Compared to the fourth quarter of 2022, its net income increased by over 700 percent, owing largely to high demand for its high-performance computing chips. In particular, the GH100, one of the most capable AI chips for servers, significantly contributed to strong sales.

Sophomore and tech enthusiast Sahil Jain has purchased NVIDIA’s graphics cards. He feels that their unique innovations set them apart from rivals like AMD.

“No one else really is competing with NVIDIA because they’re just the highest up and they have the best technology,” Sahil said. “There’s a lack of competition since other companies are so far behind compared to them in the AI game and the GPU game. NVIDIA is really the only good seller, and that’s allowed them to get so big.”

Founded in 1993 by American electrical engineers Jensen Huang, Curtis Priem and Chris Malachowsky, NVIDIA established itself as a key industry player with the release of their RIVA graphics processors and subsequently the GeForce 256, often called the world’s first GPU, a term popularized by NVIDIA. Before this point, scientists and engineers had mainly used the central processing unit (CPU) for performing tasks, designed by companies like Intel, but the GPU soon surpassed the CPU for tasks involving high volumes of instructions.

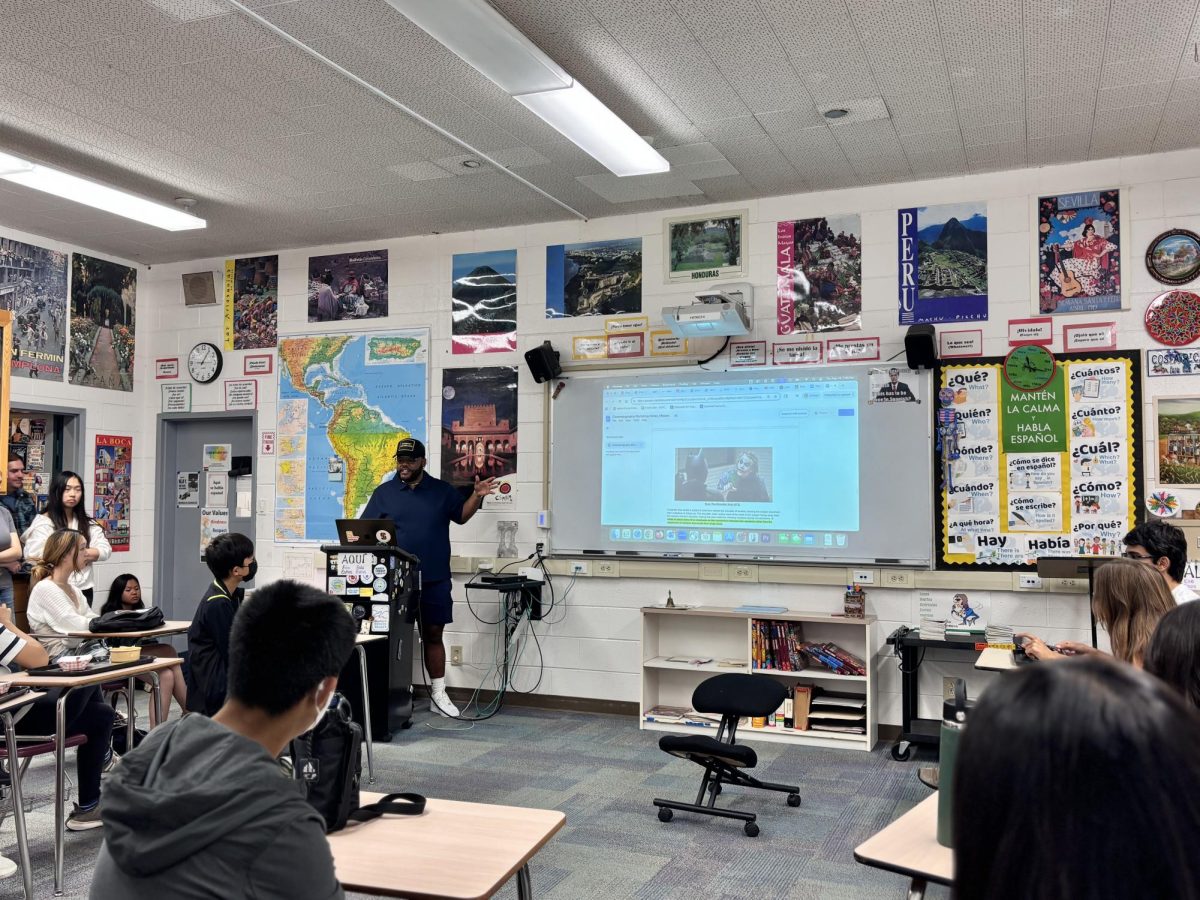

Three factors make NVIDIA GPUs especially unique. Firstly, the hardware and chips built into each processing unit are extremely fast, with their H100 chip providing 3 terabytes per second of bandwidth. Secondly, users can also customize their GPUs, tailoring the internal settings to specific applications, whether that be gaming or AI. This feature contributes to the general versatility of NVIDIA’s product, adding optimizations that can speed up processing. Finally, NVIDIA GPUs can connect to one another in a seamless manner, allowing them to run in parallel which merges their computation power. Considering how NVIDIA is developing chips specifically for AI functionalities, upper school economics teacher Dean Lizardo believes that AI will drive the decisions of most, if not all, technology companies in the future.

“As AI continues to grow, my guess is that you’re going to see a lot of industries or a lot of businesses crop up to try and fill this gap if there is any,” he said. “And so I think you will see tech find a way to make many, many use cases out of AI. It’s just a matter of time.”

In the past two decades, GPU computing has transformed into the mainstream option for processing. The soaring popularity of gaming, blockchain, and learning models has only increased the demand for NVIDIA’s processing units, snowballing their success.

“I think that this momentum is likely to continue if you look at the revenues from data centers which heavily rely on Nvidia’s GPUs,” Harker Oeconomia president Andy Chung (11) said. “It just looks as if their revenue growth and profit growth is going to continue to increase. I’m very, very excited to see what they can do.”

![“[Building nerf blasters] became this outlet of creativity for me that hasn't been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but I've had to learn from [the skills needed from] soldering to proper painting. There's so many different options for everything, if you think about it, it exists. The best part is [that] if it doesn't exist, you can build it yourself," Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and it's played such a major role in who I've become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something I'm [really] proud of,” Anvitha Tummala ('21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you aren't going to get those championships if you aren't fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

![“I'm not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that there's a lot of people that are really confident in what they do, and I really admire them. Everyone's so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)