Silicon Valley Bank failure worst in 15 years

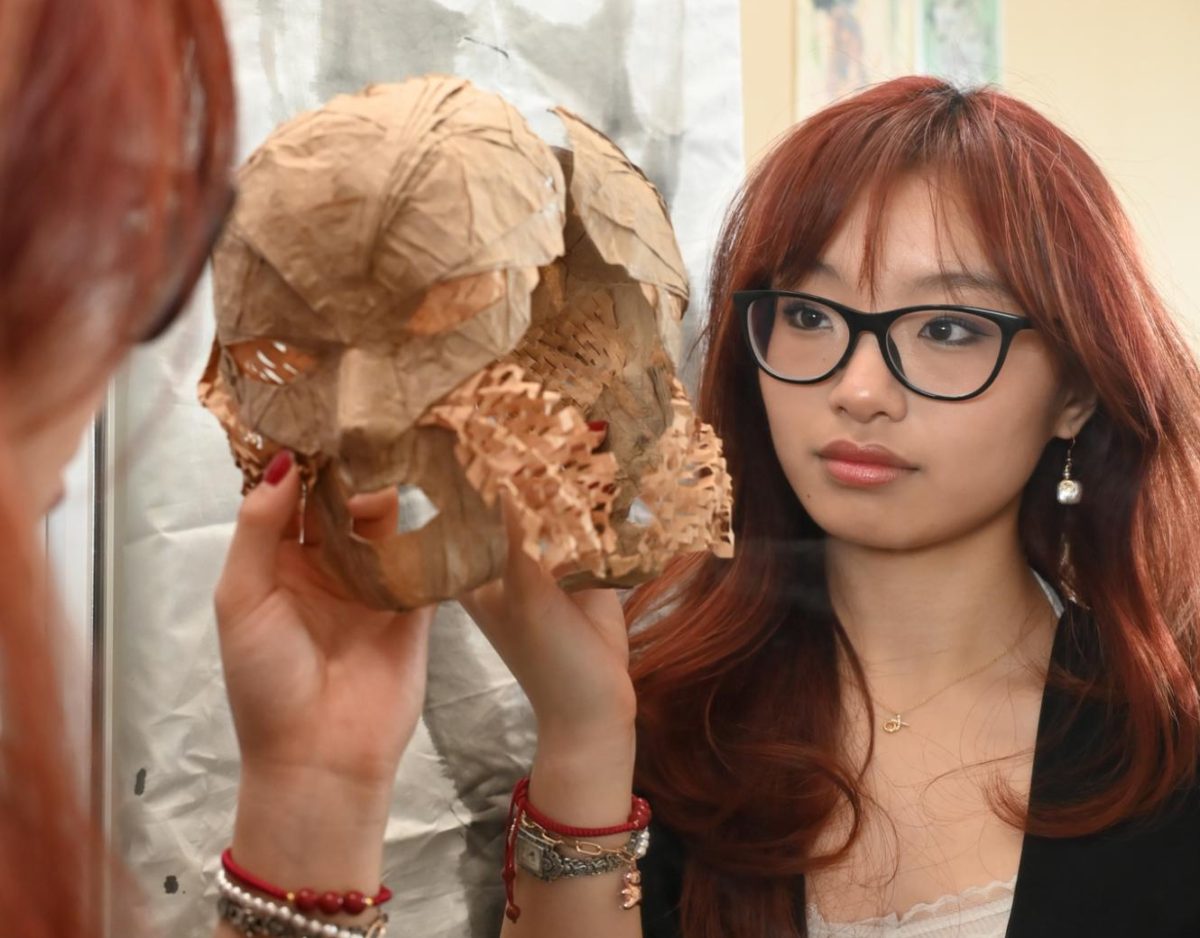

The Silicon Valley Bank headquarters in Santa Clara. Silicon Valley Bank (SVB), one of the biggest American banks in the technology and medical sectors, collapsed on March 10, marking the second largest bank failure in U.S. history.

Silicon Valley Bank (SVB), one of the biggest American banks in the technology and medical sectors, collapsed on March 10, marking the second largest bank failure in U.S. history.

With over 209 billion USD in assets at the end of 2022 and having provided investments to almost half of all American venture-based companies, SVB’s collapse has sent shockwaves across the globe.

Troubles arose after SVB’s decision to invest most of its assets in long-term government bonds, a practice many banks employ, proved problematic when the Federal Reserve began increasing interest rates in a bid to keep inflation at bay. In anticipation of an impending disaster caused by the economic downturn, several clients withdrew their money, forcing SVB to sell its investments at a steep deficit, compounding to an over 1.8 billion loss in a single day.

As fears cascaded over SVB’s solvency, depositors scrambled to withdraw their funds, triggering the biggest bank run since 2008. With SVB unable to process all the requests, the bank collapsed. Upper school computer science teacher Anuradha Datar explains that compounding fears exacerbated the issue, driving SVB to crumble.

“If so many people hadn’t tried to withdraw their money, SVB would have been able to hold their deposits until full term,” Datar said. “So I feel that [panic] caused the problem to explode. But it’s also very natural; it’s human instinct. If you have your hard-earned money stored somewhere, and you feel like there’s a threat to it, you want to go and make sure it’s okay.”

Much of the bank’s clientele consisted of technology firms, ranging from small start-ups to wealthier corporations like Circle and Roblox. With the failure of Futures Exchange (FTX) looming large over the tech industry, SVB’s base was more inclined to pull out assets at the first sign of trouble. Coupled with the digitalization of Silicon Valley as a whole, only a few individuals’ fears had the power to start an entire bank collapse, states upper school business teacher Patrick Kelly.

“The kinds of people that were putting their money into SVB are paying attention to what’s going on in the greater business landscape,” Kelly said. “So, because everybody is listening to the same sources, all it took was a few influential people to say ‘Silicon Valley Bank is not doing very well right now, take your money out of it,’ which had the potential to start a bank run.”

As the bank’s funds quickly depleted, SVB tumbled into free fall when depositors tried to withdraw over 42 billion dollars on March 9. While the Federal Deposit Insurance Corporation (FDIC) insures most banks, they only cover $250,000 per account, which was inadequate for over 90% of SVB’s primarily corporate client base. Due to the insufficient coverage provided by the FDIC, the Federal Reserve stepped in three days later and announced that they would reimburse all depositors of SVB in full, utilizing non-taxpayer funds. BeCon speaker Anish Jain (11) commends the government for being so quick to act.

“I will credit the Federal [Reserve] for doing a good job establishing things like the FDIC that make it so that these bank runs aren’t as scary anymore,” Anish said. “Most people, most companies didn’t suffer too much of a loss. Whereas back when they happened in the Great Depression or before, people went completely bankrupt.”

While government action has minimized the financial loss of SVB’s clients, the bank’s collapse has impacted economic development around the world. On March 12, two days after SVB’s failure, Signature Bank, a New York-based bank with 110 billion in assets, also collapsed. Credit Suisse, the second-largest lender in Switzerland, saw its share prices plummet to 24% on March 15. In the U.S., First Republic Bank’s stock tumbled precariously, falling 88% since its pre-SVB-collapse evaluation.

After the initial aftershocks of SVB’s collapse, all three crises have settled to some extent. The FDIC intervened in the case of Signature Bank, reimbursing all depositors. Switzerland’s central bank has stepped in to save Credit Suisse, granting a loan of 54 billion. And after 11 of America’s largest banks came together to rescue First Republic Bank, its share prices have also now stabilized. Reflecting on the entire ordeal and its resolution, Kelly advises all to remain calm in the face of crisis.

“When people are panicking, it’s usually not the end of the world,” Kelly said. “Think long term. Look at things in historical context. And you’ll usually see that the unprecedented times that we’re living in are not that unprecedented.”

Jonathan Xue (12) is an Editor-in-Chief of Humans of Harker, and this is his third year on staff. This year, he looks forward to telling the stories of...

![“[Building nerf blasters] became this outlet of creativity for me that hasn't been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but I've had to learn from [the skills needed from] soldering to proper painting. There's so many different options for everything, if you think about it, it exists. The best part is [that] if it doesn't exist, you can build it yourself," Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and it's played such a major role in who I've become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something I'm [really] proud of,” Anvitha Tummala ('21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you aren't going to get those championships if you aren't fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

![“I'm not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that there's a lot of people that are really confident in what they do, and I really admire them. Everyone's so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)