Rising college costs affect seniors’ choices

On a chilly November night, Adora Svitak slept on the floor of University of California at Berkeley’s Wheeler Hall, trading her bed for the tiles.

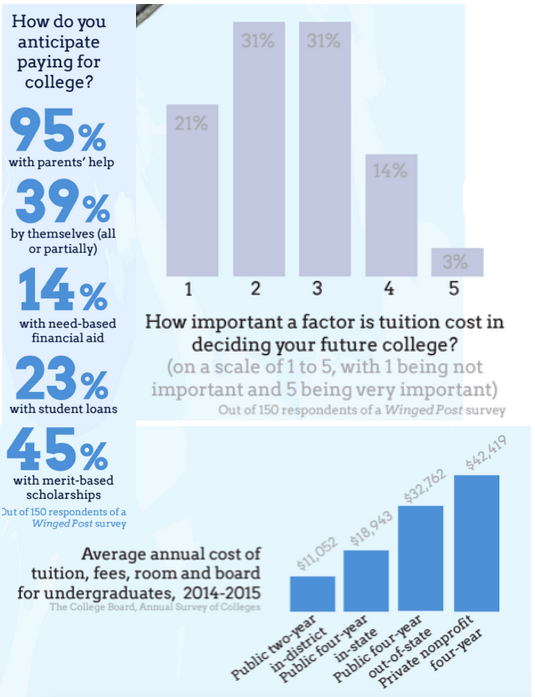

The Cal freshman was one of hundreds who camped out in the building overnight in an event called “Occupy Wheeler” or “Wheeler Commons,” protesting a UC Regents committee vote to increase UC tuition by about five percent every year for the next five years, bumping next year’s in-state student tuition from $12,192 to $12,804 and ultimately to $15,564 in 2019 — not including additional fees, books and room and board.

“It was inspiring to see how such a cross-section of university students showed up, not just those traditionally involved in protest or campus activism,” Adora wrote in an email interview. “As an out-of-state student coming from a middle-class family, I already face a massive tuition burden and a tuition increase would only increase stress on my family. Increasing tuition is a short-sighted approach that makes it harder for incredible students to choose to come to Berkeley.”

The UC’s proposed tuition hikes reflect a consistent trend of rising costs facing prospective college students — college tuition continues to climb ever higher in the U.S., according to a 2014 Bloomberg report, increasing by more than the national inflation rate yet again in an upward trend that has sparked debate among students and parents across the country.

Tuition and fees at private nonprofit colleges climbed 3.7 percent on average to $31,231 this academic year, according to the College Board.

Upper School College counselor Martin Walsh laid out the considerations that Harker seniors take into account when assessing their available college choices, naming program fit and the prestige of the university.

Walsh added that, for some Harker students, cost is often an afterthought, though for others, the amount of money may become a daunting obstacle.

Generally, colleges with distinguished names come at a steep price. Many Ivy League and other ‘brand name’ colleges do not offer merit scholarships and have higher price tags than state schools, creating a dilemma for students choosing whether to prioritize name brands or college affordability.

Senior Savi Joshi faced a tough decision — choosing between attending a private university on a full ride or not receiving any financial aid at a highly-regarded out-of-state private school. Her choice to attend the University of Pennsylvania’s Wharton School had personal consequences.

“I will be taking a job over the summer,” Savi said. “I really want to decrease the burden on my parents and that’s why it was a hard choice to choose Wharton over the full scholarship.”

According to her, the long-term benefits of a private, prestigious institution provided enough rationale for Savi to move forward with her decision.

Upper School parents and guardians are used to long-term financial planning for the purpose of educating their children. Though 12.5 percent of the Upper School community receives some form of financial aid, the majority of parents pay the full $40,500 annual tuition at the Upper School.

“They say cost isn’t really important as long as I’m happy and I’m doing what I like to do,” Vivian Jou (12) said of her parents. “I feel like as long as I repay them with not just money, [but] some work or some goal I can achieve, it will be fine.”

Many Upper School families fall above the income brackets required for need-based aid at most colleges.

“We put aside a ton of money for this,” Herng-Jeng Jou, Vivian’s mother, said. “I tried [applying for financial aid] once for my son. Once we put in our tax return data, we found out there was no way we can get the financial aid.”

But Harker alumni at college acutely feel the pinch of tuition increases.

UC Berkeley student and Harker alumna Leslie Tzeng (’14) shared her perspective on the tuition hikes.

“I’m against the tuition increases, especially because of the way they were passed by UC Regents. From what I remember, Napolitano didn’t discuss the issue with student leaders before making her decision,” she said, referring to Janet Napolitano, president of the UC system, who has been heavily criticized by students for her handling of the situation.

Better solutions, Adora commented, exist besides a tuition hike.

According to data from the Labor Department, the consumer price index (CPI) for college tuition grew by nearly 80 percent between August 2003 and August 2013, nearly twice as fast as cost growth in medical care.

Adora believes this growth in cost robs the country of its most needed investment–in a generation of workers and thinkers.

“The rising cost of college is about way more than me as an individual student not wanting to be broke,” she wrote. “It’s about wanting my country to not be intellectually bankrupt in the future, too.”

Senior David Lin emphasized the long-term planning and investment that his parents devote to pay for college.

“[My parents] work really hard,” David said. “They save for college, just like they save for Harker tuition, too.”

Elisabeth Siegel (12) is the editor-in-chief of the Winged Post. This is her fourth year in Journalism, and she especially loves production nights and...

Kacey Fang (12) is the Managing Editor for The Winged Post. She has been part of the journalism program since freshman year and served as Features Editor...

Kavya Ramakrishnan (12) is the managing editor of the Winged Post. This is her fourth year on staff, having previously held the positions of reporter and...

Emma Yu (9) is a reporter for The Winged Post. In her free time, she usually draws, surfs the internet, and hopes for no tests in the upcoming weeks of...

![“[Building nerf blasters] became this outlet of creativity for me that hasn't been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but I've had to learn from [the skills needed from] soldering to proper painting. There's so many different options for everything, if you think about it, it exists. The best part is [that] if it doesn't exist, you can build it yourself," Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and it's played such a major role in who I've become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something I'm [really] proud of,” Anvitha Tummala ('21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you aren't going to get those championships if you aren't fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

![“I'm not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that there's a lot of people that are really confident in what they do, and I really admire them. Everyone's so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)