Where macroeconomics falls short

As time goes on and we observe the continuing dynamism of the economy, we will gather more data that will enable macroeconomists to find stronger correlations.

April 19, 2017

Given that economies form the framework of modern society, it is inevitable that the most contentious political debates concern competing methods of managing American wealth for the most optimal long- and short-term outcomes. Whether or not one understands the subject of economics, almost everyone holds an opinion on the “correct” policies for prosperity, but people must realize that there is not yet enough evidence behind many macroeconomic theories.

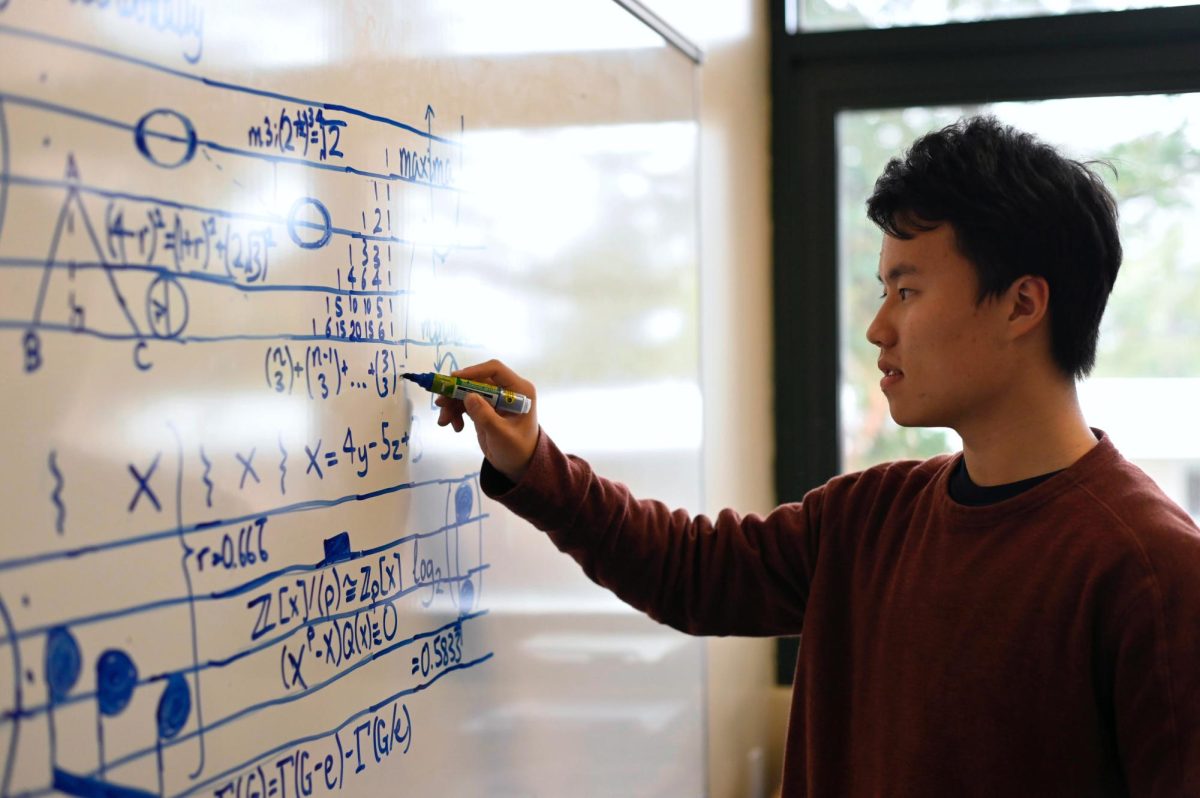

In a science like microeconomics, a researcher can strongly associate actions with results in a controlled environment like a firm. But since a plethora of social factors, economic circumstances, technological changes, incentives and policies operate independently to produce changes in the economy, macroeconomic models cannot accommodate all these elements.

As AP Economics focuses on macroeconomics this semester, I have come to view the subject as inherently flawed, as it is based off massive, complex systems that are nearly impossible to draw highly accurate conclusions from.

It is somewhat of a running joke in the economics community that macroeconomists take on too large of a task. When the Oeconomia club hosted Berkeley economics professor Dr. Steve Tadelis for a keynote on Feb. 24, I laughed when he joked that he “had no idea” what macroeconomists really do.

I understood Tadelis’ jab after I did some research of my own into the U.S. economy. During a debate among my friends about the efficacy of supply-side economic policy—where business and income taxes are cut to boost production and the profits “trickle down”—I sought to use evidence to make a strong macroeconomic argument.

In 1981, former President Ronald Reagan slashed taxes on top earners by 42 percent, instituting a uniform tax rate of 28 percent across all income levels, and cut business taxes by six percent. On top of these policies, Reagan tripled the national deficit through increasing government spending to about $2.75 billion from $980 million. Just two years later, the recession ended and immense growth followed.

Former President George W. Bush similarly implemented a series of tax cuts on income and business investment during the 2001 recession. At the same time, then-Federal Reserve Chair Alan Greenspan implemented expansionary monetary policies by lowering the interest rate. Between 2002 and 2005, the economy grew healthily.

While these examples are specific to supply-side policies, it is easy for people to say that a set of set of policy actions can trigger prosperity alone. In both these cases, the policies seem to have brought about growth; however, they were complemented with another goliath factor, whether that be Federal Reserve actions or fiscal spending, in addition to hundreds of smaller, more invisible ones. Crediting individual policies for ushering in growth is an obtuse, myopic judgement.

As time goes on and we observe the continuing dynamism of the economy, we will gather more data that will enable macroeconomists to find stronger correlations and consequently more accurate and mutually-agreed-upon models. We should understand that claims about economic policies cannot be readily proven, at least not yet, and that in many cases, economic debates lack empirical backing. Perhaps in the future, when there is enough historical data for economists to sift through, we can all agree on a proven way to approach our economy. For now, we should embrace the fact that, while essential to analyzing the world, macroeconomics is inherently flawed, and we should be cognisant of the inadequacies of some of our everyday debates and conversations.

This piece was originally published in the pages of The Winged Post on March 28, 2017.

![Setter Emma Lee (9) sets the ball to the middle during the match against Pinewood on Sept. 12. “[I’m looking forward to] getting more skilled, learning more about my position and also becoming better friends with all of my teammates, Emma said.](https://harkeraquila.com/wp-content/uploads/2023/09/DSC_4917-2-1200x795.jpg)

![“[Building nerf blasters] became this outlet of creativity for me that hasnt been matched by anything else. The process [of] making a build complete to your desire is such a painstakingly difficult process, but Ive had to learn from [the skills needed from] soldering to proper painting. Theres so many different options for everything, if you think about it, it exists. The best part is [that] if it doesnt exist, you can build it yourself, Ishaan Parate said.](https://harkeraquila.com/wp-content/uploads/2022/08/DSC_8149-900x604.jpg)

![“Animation just clicked in a way. I had been interested in art, but that felt different. [Animation] felt like it had something behind it, whereas previous things felt surface level. I wasnt making that crazy of things, but just the process of doing it was much more enjoyable, Carter Chadwick (22) said.](https://harkeraquila.com/wp-content/uploads/2022/08/Screen-Shot-2022-08-16-at-9.44.08-AM-900x598.png)

![“When I came into high school, I was ready to be a follower. But DECA was a game changer for me. It helped me overcome my fear of public speaking, and its played such a major role in who Ive become today. To be able to successfully lead a chapter of 150 students, an officer team and be one of the upperclassmen I once really admired is something Im [really] proud of,” Anvitha Tummala (21) said.](https://harkeraquila.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-25-at-9.50.05-AM-900x594.png)

![“[Volleyball has] taught me how to fall correctly, and another thing it taught is that you don’t have to be the best at something to be good at it. If you just hit the ball in a smart way, then it still scores points and you’re good at it. You could be a background player and still make a much bigger impact on the team than you would think,” Anya Gert (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AnnaGert_JinTuan_HoHPhotoEdited-600x900.jpeg)

![“Im not nearly there yet, but [my confidence has] definitely been getting better since I was pretty shy and timid coming into Harker my freshman year. I know that theres a lot of people that are really confident in what they do, and I really admire them. Everyones so driven and that has really pushed me to kind of try to find my own place in high school and be more confident,” Alyssa Huang (’20) said.](https://harkeraquila.com/wp-content/uploads/2020/06/AlyssaHuang_EmilyChen_HoHPhoto-900x749.jpeg)

![“My slogan is ‘slow feet, don’t eat, and I’m hungry.’ You need to run fast to get where you are–you arent going to get those championships if you arent fast,” Angel Cervantes (12) said. “I want to do well in school on my tests and in track and win championships for my team. I live by that, [and] I can do that anywhere: in the classroom or on the field.”](https://harkeraquila.com/wp-content/uploads/2018/06/DSC5146-900x601.jpg)

![“I think getting up in the morning and having a sense of purpose [is exciting]. I think without a certain amount of drive, life is kind of obsolete and mundane, and I think having that every single day is what makes each day unique and kind of makes life exciting,” Neymika Jain (12) said.](https://harkeraquila.com/wp-content/uploads/2017/06/Screen-Shot-2017-06-03-at-4.54.16-PM.png)